It’s been a jaw dropping week in finance. Our hearts and thoughts are with all the start-ups and individuals that could be impacted by the shocking collapse of Silicon Valley Bank. Reports on Sunday suggest the US Government has stepped in and found a solution which will ensure depositors have access to their funds.

- Our spotlight falls on market volatility. The VIX, which is also called the Fear Index, is up 31% over the last 5 days. The KBW Bank Index is down 16% on fears of contagion and reports that US banks are sitting on $620 billion in unrealized losses from securities. However, given the systemic importance of the banking sector, can the government really afford not to take action? In addition, calls have grown louder for the Fed to pause its rate hiking program to fully analyze the effects of higher rates and not push the economy into recession.

- Over the last week, the S&P 500 dropped -4.55%, the Hang Seng fell by -6.07% and Gold gained 1.35% – indicative of worsening sentiment. Fed Chair Jerome Powell testified about monetary policy in front of the US House Financial Services Committee over March 7-8. He made it clear that the Fed is prepared to accelerate rate hikes if inflation data remains strong. Subsequently, US non-farm payroll data showed strong job growth and persistent wage inflation. This has led markets to believe Fed action and higher rates are likely.

- The coming week is also going to be a tense one. The implications of Silicon Valley Bank’s collapse need to be closely watched. The CPI report will be released on March 14. High inflation levels will further spook the market. Manchester United, who is in the middle of an ongoing takeover process, will be releasing earnings. Bidders including the Qatar Royal Family, Sir Jim Ratcliffe and Elliott Investment Management will be watching with interest. There are important earnings releases and more key events are below and on Capnote.

Was this newsletter forward to you? Sign-up and join Capnote – the modern productivity platform for financial professionals and investors. You’ll get access to patented automation and machine learning technology, global datasets and a growing professional community.

Spotlight 💡🔦

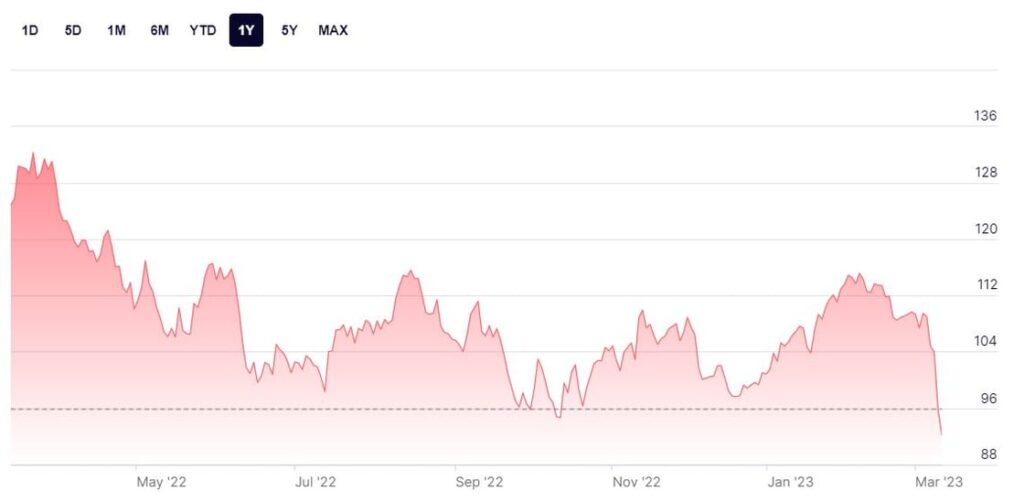

Market volatility rises during periods of economic fear and stress as investor sentiment worsens. You may be familiar with this being measured by the CBOE Volatility Index popularly known as the VIX and also referred to as the Fear Index. As a general rule of thumb, during normal stable periods, the VIX is below 20 and during stress periods it rises above 30. The chart below from Trading Economics shows the 1 year trend of the VIX with a noticeable creep up in implied volatility starting to occur. Over the last week, the VIX has increased by 31%.

In recent times, the VIX has been quite reactive to the Fed’s monetary policy and aggressive rate hikes. With economic data not showing enough progress against inflation, there is credible speculation that the Fed will continue to raise rates for longer and perhaps even accelerate their rate hiking schedule. In addition, the spectacular collapse of Silicon Valley Bank has further added to fears of possible contagion. There are reports that Signature Bank has shut by regulators and First Republic Bank was forced to seek additional liquidity from JP Morgan. More broadly across the sector, it has been projected that US banks are sitting on unrealized losses of up to $620 billion. As can be seen in the below chart from Nasdaq, the KBW Bank Index is down 16% over the last week, taking it to levels not seen since the coronavirus pandemic.

On Sunday, the Government, the Fed and FDIC announced that Silicon Valley Bank depositors will have access to their funds from Monday. If that is the case, then praise should be given to all involved for such swift action. It does point to the valuable implied support that systemic banks have which other companies and industries may not have. Being able to borrow from the Fed more easily in emergencies certainly does reduce risk. In addition, calls have grown louder for the Fed to pause its rate hiking program so as not to push the economy into recession. In the unlikely event that the Fed does pause, a mini-rally in the stock market would be expected. The FOMC meetings on March 21-22 have become even more important. Given this context, many investors will undoubtedly be asking themselves, “Is it time to be greedy or fearful?” To answer that question, seek advise from a registered financial advisor that takes into account your personal situation.

Timeline Updates ⏰

Earnings events continue this week with a notable selection below:

- 2023 1st quarter Earnings – Manchester United 2023-03-13

- 2023 1st quarter Earnings – Buzzfeed 2023-03-13

- 2023 1st quarter Earnings – Zim Integrated Shipping Servic 2023-03-13

- Consumer Price Index Report Released 2023-03-14

- 2023 1st quarter Earnings – Skillz 2023-03-14

- 2023 1st quarter Earnings – Guess 2023-03-14

- 2023 1st quarter Earnings – Volkswagen 2023-03-14

- 2023 1st quarter Earnings – Gamestop 2023-03-15

- 2023 1st quarter Earnings – Ikena Oncology 2023-03-15

- 2023 1st quarter Earnings – Cineworld Group 2023-03-15

- 2023 1st quarter Earnings – Adobe 2023-03-15

- 2023 1st quarter Earnings – Uranium Energy 2023-03-15

- 2023 1st quarter Earnings – Bmw 2023-03-15

- 2023 1st quarter Earnings – E.On 2023-03-15

- 2023 1st quarter Earnings – Williams Sonoma 2023-03-16

- 2023 1st quarter Earnings – Fedex 2023-03-16

- 2023 1st quarter Earnings – Helios Towers 2023-03-16

- 2023 1st quarter Earnings – Swatch Group 2023-03-16

- 2023 1st quarter Earnings – Academy Sports & Outdoors 2023-03-16

- 2023 1st quarter Earnings – Dollar General 2023-03-16

- 2023 1st quarter Earnings – Ballard Power Systems 2023-03-17

Check out the automated Timeline & Events section on Capnote for more.

High Performers Of The Week 🚀

Global Indicators

- UK Gas +18.27%

- TTF Gas +17.83%

- Baltic Dry +9.58%

Industries

- Real Estate +6.73%

- Scientific Research +3.94%

- Government Contractor +1.85%

Companies Over $10 Billion In Market Cap

- Sea +12.44%

- Dicks Sporting Goods +10.72%

- Bank Bradesco +5.65%

Companies Below $10 Billion In Market Cap

- Unicycive Therapeutics +445.95%

- Kimball International +82.36%

- Azul +74.76%

Deepen your expertise about key operating metrics with CFI’s dedicated accounting programs such as the “Financial Analysis Fundamentals” course.

Low Performers Of The Week 🚩

Global Indicators

- Japan 10Y -22.22%

- Natural gas -19.01%

- Canada 10Y -10.29%

Industries

- Merchandise -19.54%

- Admin & Legal -17.27%

- Digital & Cryptocurrency -15.38%

Companies Over $10 Billion In Market Cap

- Schwab Charles Corp -24.17%

- Apollo Global Management -17.54%

- Coinbase Global -17.16%

Companies Below $10 Billion In Market Cap

- Loyalty Ventures -87.26%

- Srax -65.12%

- SVB Financial Group -62.72%

View more on Capnote.

Quote of the Week

“If you have trouble imagining a 20% loss in the stock market, you shouldn’t be in stocks.” – Jack Bogle