Hello,

Greetings and welcome to another edition of Capnote’s weekly spotlight newsletter. Now read by over five thousand financial professionals, our objective is to quickly inform you of important data trends and help you prepare for another week in finance.

- Our spotlight falls on Bitcoin, the largest cryptocurrency. Up 67% year to date, Bitcoin has weathered many storms in recent times and now seems to be proving its value to investors as a store of value that is supposedly decentralized from the traditional financial system. As the ongoing crisis in banking deepens and central banks continue to grapple with inflation, there is speculation that many governments cannot afford to provide full blown support if there is a deep crisis. Is Bitcoin starting to look like not such a crazy idea after all?

- Over the last week, the S&P 500 gained +1.43%, the Hang Seng gained +1.03% and Bitcoin gained 35.85%. The markets appeared relieved the US Government took action to avert a crisis following the collapse of Silicon Valley Bank. However, there is an increasing number of banks thought to be facing difficulty. In Europe, UBS hastily agreed to rescue and acquire the collapsing Credit Suisse for $3 billion. Analysts consensus is that the Fed cannot aggressively hike rates without causing a recession.

- The coming week is critical to the health of the global financial markets. The stakes have been raised for the Fed meetings over March 21-22. The US government has rescued depositors of Silicon Valley Bank but Treasury Secretary, Janet Yellen, has reiterated that non-systemic banks are unlikely to receive support beyond FDIC insurance. There are also important earnings releases and more key event below and on Capnote.

Was this newsletter forward to you? Sign-up and join Capnote – the modern productivity platform for financial professionals and investors. You’ll get access to patented automation and machine learning technology, global datasets and a growing professional community.

Spotlight 💡🔦

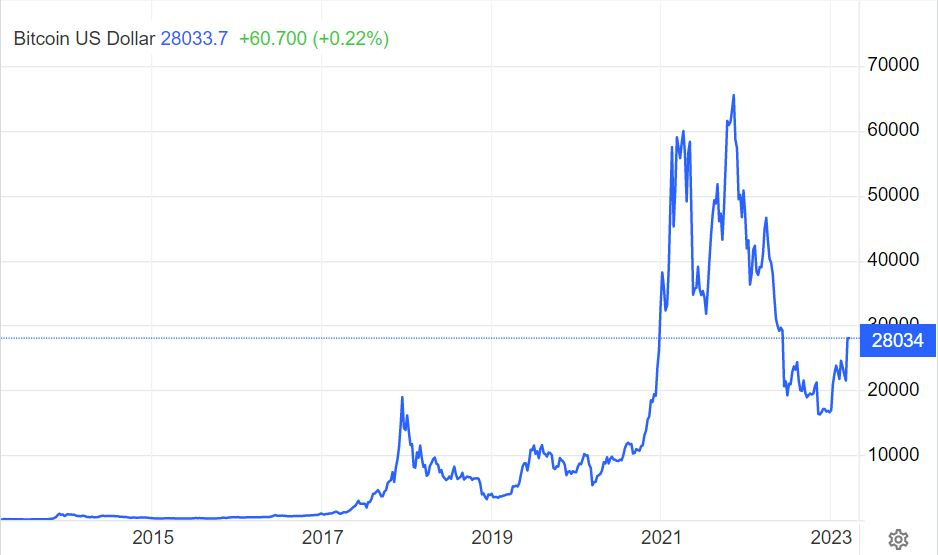

Nothing in finance splits opinion and causes social media arguments like cryptocurrency does. Its critics and believers are numerous and fervent, labelling it both fraudulent and genius with valid rationale. As the largest cryptocurrency with market cap of over $530 billion, Bitcoin is often viewed as a proxy for the entire industry. Over the last 10 years, the price of Bitcoin has had a meteoric rise from $1K to a peak of $65K and drop to over $27K at present. Up 67% year to date, the price of Bitcoin seems to show it is attracting investment in reaction to the increasing volatility and uncertainty in the financial markets.

As the banking crisis deepens, many appear to be turning to Bitcoin to store value in a medium that is suggested to be decentralized from the traditional financial system. However, it is important to note that claims of decentralization are highly contested and relatively unproven. According to Bankrate, the developing markets are the biggest drivers of Bitcoin adoption especially in countries such as Vietnam, Philippines, Ukraine, Nigeria and Kenya. There is also significant adoption in the United States with over 21% of the population thought to be holding some form of cryptocurrency, especially amongst higher income earners. Developing markets may be drawn to Bitcoin as there is a perceived lack of government support or capability during times of currency crisis. With governments across the world grappling with inflation, dry powder spent over COVID and reluctant to expand their monetary supply, many more governments may also find themselves unable to provide full blown support in an economic crisis. This has led investors to ask themselves, if there is a crisis, is the calvary coming?

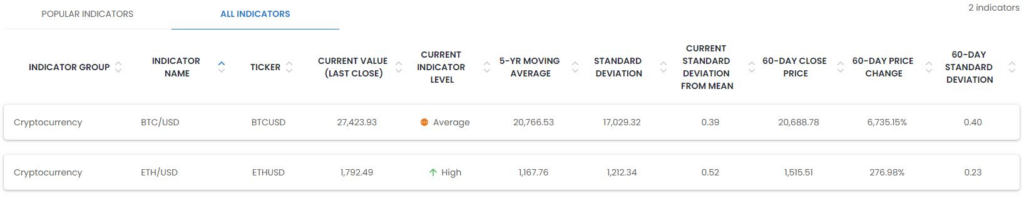

If you are thinking about dipping a toe in, it is important to note that Bitcoin is highly volatile with rapid swings up and down. As can be seen in the above indicator extract from Capnote, Bitcoin is close to its 5 year average value of $27K. Over that period, its Standard Deviation is $17K which is quite large. this volatility impacts how suitable Bitcoin is as an investment for certain demographics. It also tells you how quickly the current uptrend could reverse to the downside. Go to Capnote > Data & Analysis > Indicators to view more.

Timeline Updates ⏰

Earnings events continue this week with a notable selection below:

- 2023 1st quarter Earnings – Foot Locker 2023-03-20

- 2023 1st quarter Earnings – Shelf Drilling 2023-03-20

- 2023 1st quarter Earnings – Carnival 2023-03-20

- FOMC Scheduled meeting – 2023-03-21

- 2023 1st quarter Earnings – Gamestop 2023-03-21

- 2023 1st quarter Earnings – Citi Trends 2023-03-21

- 2023 1st quarter Earnings – Nike 2023-03-21

- 2023 1st quarter Earnings – Petrofac 2023-03-21

- FOMC Scheduled meeting – 2023-03-22

- 2023 1st quarter Earnings – Petco Health And Wellness 2023-03-22

- 2023 1st quarter Earnings – Sinopec Shanghai Petrochemical 2023-03-22

- 2023 1st quarter Earnings – Factset Research Systems 2023-03-23

- 2023 1st quarter Earnings – General Mills 2023-03-23

- 2023 1st quarter Earnings – Movado Group 2023-03-23

- 2023 1st quarter Earnings – Oxford Industries 2023-03-23

- 2023 1st quarter Earnings – Accenture 2023-03-23

- 2023 1st quarter Earnings – China Petroleum & Chemical 2023-03-24

- 2023 1st quarter Earnings – Smiths Group 2023-03-24

- 2023 1st quarter Earnings – China Pacific Insurance 2023-03-24

- 2023 1st quarter Earnings – Ceres Power Holdings 2023-03-24

Check out the automated Timeline & Events section on Capnote for more.

High Performers Of The Week 🚀

Global Indicators

- BTC/USD +35.85%

- ETH/USD +25.42%

- Lumber +23.20%

Industries

- Digital & Cryptocurrency +75.48%

- Internet technologies +11.36%

- Delivery & Mail +9.87%

Companies Over $10 Billion In Market Cap

- Coinbase Global +40.31%

- Advanced Micro Devices +18.35%

- Docusign +17.77%

Companies Below $10 Billion In Market Cap

- Provention Bio +258.05%

- Ainos +120.59%

- Elevation Oncology +112.32%

Deepen your expertise about key operating metrics with CFI’s dedicated accounting programs such as the “Financial Analysis Fundamentals” course.

Low Performers Of The Week 🚩

Global Indicators

- Switzerland 10Y -28.97%

- Japan 10Y -28.57%

- UK Gas -21.76%

Industries

- Pipelines -17.96%

- Lending & Credit -17.34%

- Space Logistics -16.46%

Companies Over $10 Billion In Market Cap

- Keycorp -26.37%

- Huntington Bancshares Inc -22.66%

- Truist Financial Corp -21.32%

Companies Below $10 Billion In Market Cap

- Boxed -76.83%

- Esperion Therapeutics -66.08%

- Diebold Nixdorf -64.85%

View more on Capnote.

Quote of the Week

“Bitcoin is absolutely the Wild West of finance, and thank goodness. It represents a whole legion of adventurers and entrepreneurs, of risk takers, inventors, and problem solvers. It is the frontier. Huge amounts of wealth will be created and destroyed as this new landscape is mapped out.” – Erik Voorhees