Hello,

Welcome to another edition of Capnote’s weekly spotlight newsletter. Our objective is to help you outperform by highlighting important data trends.

- This week, our spotlight falls on oil of a much tastier variety. Palm oil prices have been on a rollercoaster journey over the last 12 to 18 months, reaching all time highs in April 2022 and then slumping 51% to date. Given palm oil is used extensively in a number of industries including food, cosmetics, biofuels and others, the dynamics and outlook of this key feedstock should be actively monitored.

- Over the last week, the S&P 500 gained +1.39%, the Hang Seng gained +2.03% and Crude Oil gained 2.77%. These indicators seem to suggest recessionary fears are reducing. The Fed raised rates by 25bps in line with market expectations and also communicated that there is less to be done with monetary policy, meaning rate hikes may end sooner than previously guided. The ongoing banking crisis is expected to reduce liquidity and credit in the global economy which should provide deflationary pressure.

- In the coming week, the fallout from the banking crisis is expected to continue. With significant unrealized losses from treasury securities still held on the balance sheets of banks, the market is holding its breath and wondering who will fall next. There are also important earnings releases such as for Vale, Walgreens Boots Alliance and Lulu lemon. View this and more key events on Capnote.

Was this newsletter forward to you? Sign-up and join Capnote – the modern productivity platform for financial professionals and investors. You’ll get access to patented automation and machine learning technology, global datasets and a growing professional community.

Quote of the Week

“Since our previous FOMC meeting, economic indicators have generally come in stronger than expected, demonstrating greater momentum in economic activity and inflation. We believe, however, that events in the banking system over the past two weeks are likely to result in tighter credit conditions for households and businesses, which would in turn affect economic outcomes. ”

– Chair Jerome Powell’s press conference 22 March 2023

Spotlight 💡🔦

“How the world got hooked on palm oil”, is an aptly titled article from the Guardian which highlights the broad variety of industrial uses of palm oil in modern life. It’s in everything from food products like ice cream and cookies to cosmetic and household products such as shampoo and lipstick. In today’s world, palm oil is probably harder to avoid than consume. Malaysia and Indonesia account for close to 85% of global production with other countries like Nigeria, Colombia and Thailand also important producers.

The below 5 year chart from Trading Economics highlights the rollercoaster that palm oil prices have been on over the last 12-18 months. The ramp up to all time highs in April 2022 was mostly caused by supply side shocks. Global exports and stocks of edible oils fell due to the Ukraine war. Ukraine was the largest exporter of sunflower oil. With those exports unavailable, more demand turned to palm oil as a substitute. In addition, Indonesia implemented a temporary export ban on palm oil in 2022 in order to ensure domestic food security, which further contributed to the price spiking. Since then, prices have slumped by 51% to 3512 MYR/T (approximately 792 USD / T).

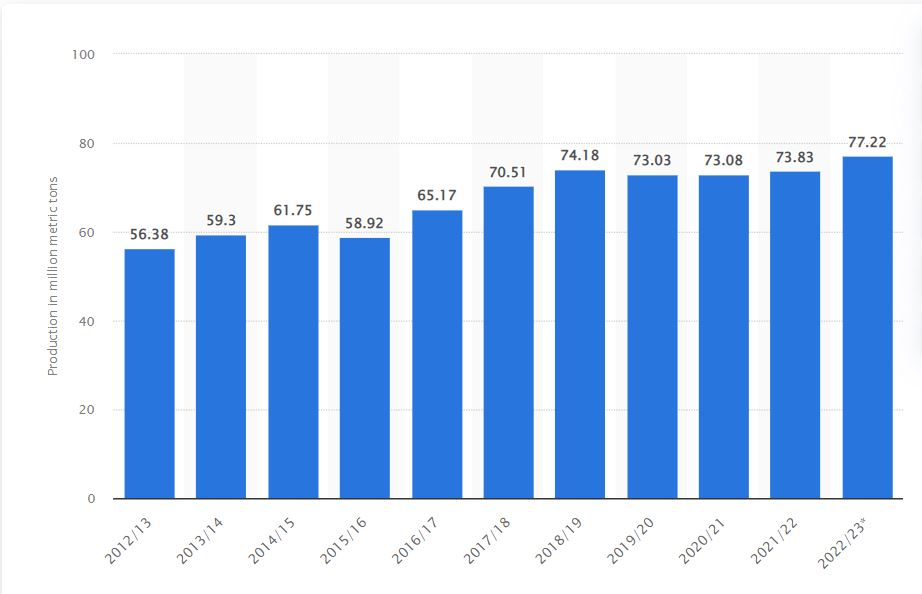

The largest importers of palm oil are India, China, Pakistan, USA and the Netherlands. The volatility in palm oil prices contributed to global inflation, which appears to be waning. The supply of palm oil is increasing. The export ban in Indonesia created a mass of unsold supply which is now hitting markets. The below trend diagram from Statista shows the increase in the global production of palm oil in millions of metric tons over the last 10 years.

The demand for palm oil is also falling on concerns over environmental, social and governance (ESG) issues. The production of palm oil has led to forests being burned down in order to make land available to plant more palm trees. This leads to pollution as well as destruction of wildlife habitat. With sustainability becoming increasingly important for businesses, many are looking for alternatives to palm oil. For example, the European Union recently amended regulations to limit the importation of palm oil for biofuels due to the ESG issues highlighted above. This is contributing to a decline in the price of palm oil and subsequently a decline in inflation given how wide spread palm oil use is in global industry.

The price of palm oil is expected to continue to fall in 2023 due to increased supply and stagnant demand. However, this could change if demand from China increases further following their economic reopening after the pandemic or if Pakistan is able to solve its macroeconomic issues. Go to the indicators section on Capnote for more details on palm oil prices, their historic averages and standard deviations over the last 5 years.

Timeline Updates ⏰

Earnings events continue this week with a notable selection below:

- 2023 1st quarter Earnings – Excelerate Energy 2023-03-27

- 2023 1st quarter Earnings – Vale 2023-03-27

- 2023 1st quarter Earnings – Acumen Pharmaceuticals 2023-03-27

- 2023 1st quarter Earnings – Tsingtao Brewery 2023-03-27

- 2023 1st quarter Earnings – American Resources 2023-03-27

- 2023 1st quarter Earnings – Walgreens Boots Alliance 2023-03-28

- 2023 1st quarter Earnings – Byd 2023-03-28

- 2023 1st quarter Earnings – Lululemon Athletica 2023-03-28

- 2023 1st quarter Earnings – Mccormick & Company 2023-03-28

- 2023 1st quarter Earnings – Virgin Orbit Holdings 2023-03-28

- 2023 1st quarter Earnings – Next 2023-03-29

- 2023 1st quarter Earnings – Advent Technologies 2023-03-31

- 2023 1st quarter Earnings – H&R 2023-03-31

Check out the automated Timeline & Events section on Capnote for more.

High Performers Of The Week 🚀

Global Indicators

- Switzerland 10Y +18.74%

- Tin +10.31%

- Turkey 10Y +7.30%

Industries

- Plastics & Rubber +16.54%

- Consulting +6.18%

- Distribution +5.87%

Companies Over $10 Billion In Market Cap

- On Holding +46.62%

- Coupang +16.19%

- Nio +9.81%

Companies Below $10 Billion In Market Cap

- U.S. Xpress Enterprises +286.98%

- Lifecore Biomedical +86.96%

- Quince Therapeutics +79.73%

Deepen your expertise about key operating metrics with CFI’s dedicated accounting programs such as the “Financial Analysis Fundamentals” course.

Low Performers Of The Week 🚩

Global Indicators

- 10Y TIPS -12.90%

- Lumber -8.42%

- Palm Oil -6.66%

Industries

- Scientific Research -15.68%

- Pets -12.11%

- Jewelry & Ornaments -3.89%

Companies Over $10 Billion In Market Cap

- Pinduoduo -18.79%

- Block -17.98%

- Chewy -12.26%

Companies Below $10 Billion In Market Cap

- Qutoutiao -74.07%

- Altimmune -60.76%

- Credit Suisse Group Ag -57.16%

View more on Capnote.