Hello,

Welcome to another edition of Capnote’s weekly spotlight newsletter. Our objective is to help you outperform by highlighting important data trends.

- This week our spotlight falls on the BRICS (Brazil, Russia, India, China, South Africa) alliance, a trading bloc that is rapidly becoming a geopolitical alternative to the G7. Recently the members have made progress on efforts to move away from trading in USD with the Chinese Yuan, a prospective new trade currency among members.

- Over the last week, the S&P 500 gained +3.48%, the Hang Seng gained +2.43% and Crude Oil gained 7.08%. Virgin Orbit is on the edge of bankruptcy. On March 30, 2023, the company stopped operations and laid off almost all their staff. Currently their stock is trading at $0.20. On Thursday Nikola Motor Company announced that their $100 million secondary stock offering has been priced at $1.12 per share, closing at $1.21 on Friday.

- In the coming week, regulators are proposing an expansion on requirements to issue long term debts to regional banks with assets over $700 billion. Bed Bath & Beyond will be closing hundreds of stores after being sued by their former chief executive over an unpaid severance of $6,765,000. UK business are facing a rise in corporation taxes, rising from 19% to 25% this month. View this and more key events on Capnote.

Was this newsletter forward to you? Sign-up and join Capnote – the modern productivity platform for financial professionals and investors. You’ll get access to patented automation and machine learning technology, global datasets and a growing professional community.

Quote of the Week

“But the petrodollar system is not about oil, per se. It is about a system of sustaining the worldwide need for a paper currency by linking it to a true global necessity – oil.”

– Kelly Mitchell, author of Gold Wars, The Battle for the Global Economy

Spotlight 💡🔦

What started as a loosely formed trading alliance, is now being recognized as a geopolitical alternative to the G7. Founded on 16 June 2009, BRICS stands for Brazil, Russia, India, China, and South Africa. Of late, a major prospect looking to join the alliance is Saudi Arabia, one of the world’s largest producers of crude oil. Every year a BRICS summit is held. This year, it will be on August 22-24 in South Africa and particularly important. BRICS has been in the news recently for their exclusion of the USD in trade dealings and suggestions that they are set to create a new global currency. According to The Wall Street Journal, Saudi Arabia and China are close to conducting oil sales in Yuan instead of the petro-dollar (USD). Brazil and China have also come to an agreement to trade commodities in their respective currencies instead of USD. While these discussions have been on and off for years, it appears, that this year, there has been an acceleration in their plans to disrupt USD as the global currency for trade.

For over 60 years the USD has been the world’s most dominant reserve currency. This has given the United States significant economic and political leverage. While the USD is expected to remain the world’s most dominant reserve currency, these developments have made analysts wonder if its dominance could be slipping. Below is a 10 year currency trend of Yuan against USD from Trading Economics, showing depreciation of the Yuan against the USD.

Whilst it is not clear precisely why this is happening, there have been various theories in the press such as:

- Strengthening of the dollar in response to the Fed’s rapid rates increases

- Reduction of China’s economic growth forecasts during the pandemic

- Rumors of deliberate devaluation by China to make its exports more competitive

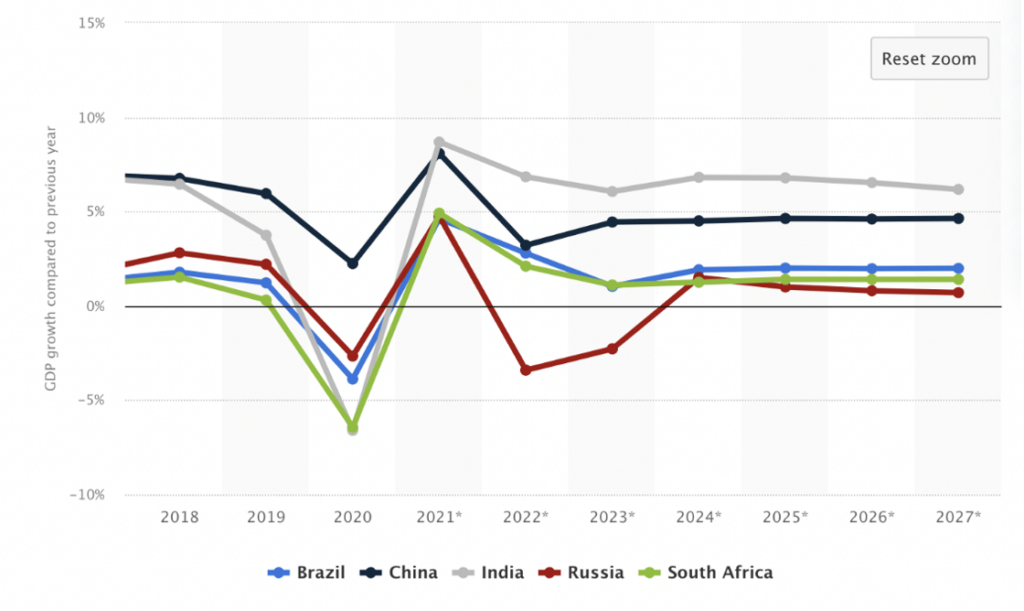

Though analysts do not seem to agree on the reasons why, it is clear that these currency movements and discussions will continue to be front and center as BRICS further develops. Composed of some of the largest emerging economies in the world, BRICS holds a combined bloc GDP of over 24.73 trillion U.S dollars, 16% in world trade, and 41% of the world’s population. Creating a new global currency would potentially allows members of the bloc to realize some efficiency gains by eliminating conversions to USD and leading to appreciation of their currencies. Below is a graph of BRICS countries’ GDP growth rate from 2018 and to its expected rate in 2027 from Statista.

The BRICS’ New Development Bank has dedicated $32.8 billion to financing sustainable development projects in the emerging markets. Their top projects include an emergency gas reserve in Beijing, a Qingdao metro line six, and the restructuring of the Rajasthan water sector. These funding opportunities are likely to make BRICS an attractive prospect for new members. Across the world, many are waiting to see how the United States and the G7 will react to recent developments. The options either appear to be a collision of some type or a new multipolar financial world. Analysts and companies are prudently preparing for the impact of either scenario.

Timeline Updates ⏰

Earnings events continue this week with a notable selection below:

- 2023 2nd quarter Earnings – U.S. Energy 2023-04-03

- 2023 2nd quarter Earnings – Kirkland’s 2023-04-04

- 2023 2nd quarter Earnings – Kura Sushi Usa 2023-04-04

- 2023 2nd quarter Earnings – Smart Global Holdings 2023-04-04

- 2023 2nd quarter Earnings – The Simply Good Foods 2023-04-05

- 2023 2nd quarter Earnings – Nurix Therapeutics 2023-04-05

- 2023 2nd quarter Earnings – Hallmark Financial Services 2023-04-05

- 2023 2nd quarter Earnings – Levi Strauss & Company 2023-04-06

- 2023 2nd quarter Earnings – Lamb Weston Holdings 2023-04-06

- 2023 2nd quarter Earnings – Sprinklr 2023-04-06

- 2023 2nd quarter Earnings – Aluminum Corporation Of China 2023-04-07

Check out the automated Timeline & Events section on Capnote for more.

High Performers Of The Week 🚀

Global Indicators

- Japan 10Y +13.29%

- TTF Gas +13.03%

- Crude Oil (WTI) +9.28%

Industries

- Merchandise +17.57%

- Infrastructure +13.91%

- Digital & Cryptocurrency +12.89%

Companies Over $10 Billion In Market Cap

- First Citizens Bancshares Inc +67.04%

- Nio Inc. +15.88%

- Lululemon Athletica Inc. +15.86%

Companies Below $10 Billion In Market Cap

- Palisade Bio, Inc. +114.86%

- Local Bounti +113.99%

- Brainstorm Cell Therapeutics Inc +113.78%

Deepen your expertise about key operating metrics with CFI’s dedicated accounting programs such as the “Financial Analysis Fundamentals” course.

Low Performers Of The Week 🚩

Global Indicators

- Natural gas -8.05%

- Russia 10Y -7.45%

- Baltic Dry -5.51%

Industries

- Cannabis -2.83%

- Internet technologies -1.26%

- Space Logistics -1.22%

Companies Over $10 Billion In Market Cap

- Match Group -4.50%

- Baidu, Inc. -3.42%

- Humana Inc. -3.38%

Companies Below $10 Billion In Market Cap

- Virgin Orbit Holdings -75.00%

- Nogin -73.00%

- Cyxtera Technologies -63.68%

View more on Capnote.