Hello,

Welcome to another edition of Capnote’s weekly spotlight newsletter, where we investigate data trends in finance and industry to help you outperform.

- This week our spotlight falls on coffee – the magical bean that’s integral to productivity and culture. In the last week, the commodity has increased by over 7% and over the last 5 years, it has increased by over 57%. It’s estimated that over 2.25 billion cups of coffee are consumed each day. However, will the magic of coffee be able to keep us up in a recession? Read more below.

- Over the last week, the S&P 500 was flat, US 10 year treasury yields fell and crude oil gained 6%, following OPEC’s surprise production cut. Gold gained 2% as recession fears, the banking crisis and changing currency dynamics continue to cause anxiety. Tesla reported a new deliveries record of 422,875 vehicles in the first quarter, up from 405,278 vehicles in Q4 2022. However analysts are concerned about profit margins and building inventories.

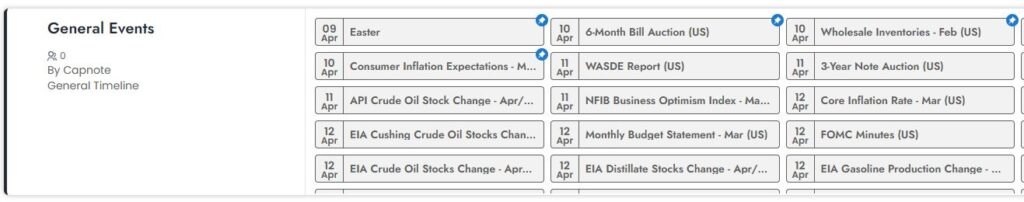

- In the coming week, minutes of the last FOMC meeting will be released, which will be keenly analyzed for hints about the Fed’s views on inflations and rates. A positive read could fuel more upward momentum in the markets. There is also a notable earnings release for Bed Bath & Beyond which is fighting to avoid bankruptcy. There are also earnings releases for industry leaders such as Delta Airlines. See below for more.

Sign-up and join Capnote – the modern productivity platform for financial professionals and investors. You’ll get access to patented automation and machine learning technology, global datasets and a growing professional community.

Quote of the Week

“I made money in Dunkin Donuts. I could understand it. When there were recessions I didn’t have to worry about what was happening. I could go there and people were still there…You laugh but I made 10 or 15 times my money in Dunkin Donuts. Those are the kind of stocks I can understand. If you don’t understand it, it doesn’t work. This is the single biggest principle.”

– Peter Lynch (video clip)

Spotlight 💡🔦

Coffee addicts (which are numerous in financial services) and neutrals are united in the understanding that coffee has changed the world. Some even credit it with fueling the industrial revolution. The magical bean has a wide variety of industrial applications ranging from retail consumption in food and beverages to pharmaceutical, beauty, agriculture and many others. Over the last 5 years, the price of coffee has increased by more than 57%, as can be seen in the below chart from Trading Economics.

In 2022, coffee prices reached 10 year highs driven by supply shortages particularly in Brazil, where there was a poor harvest, primarily due to environmental reasons. This undoubtedly contributed to inflation in the the largest coffee importing countries such as the the United States, Germany, France, Italy, Canada and Japan. The Bureau of Labor Statistics estimates that the average cup of coffee in the US increased in price by 25% between 2021 and 2022. This shortfall in coffee supply against demand is expected to persist in 2023 despite production gains in South America and Africa. The largest producers of coffee are shown in the below illustration from the Visual Capitalist.

The largest coffee companies in the world such as Starbucks and Nestle appear to have been able to adequately absorb any incremental costs and pass these onto consumers. Over the same 5 year period, Starbucks stock is up 76% and its revenue has risen from $24.7 billion in 2018 to $32.3 billion in 2022. However, EBITDA margins have fallen from 26% to 19%. This suggests that increased costs could not be totally passed onto the consumer.

To further understand how coffee will react in a recession, it is worth reading this research paper from the International Coffee Organization written during the global financial crisis. It suggests that whilst consumption of coffee remained relatively constant, consumers did shift from out-of-home to in-home consumption and from higher cost products to cheaper brands. “This trend to less expensive products is corroborated by the strong results reported by discount food retailers and by reduced earnings in the specialty coffee sector in the last quarter of 2008.”

Timeline Updates ⏰

Earnings events continue this week with a notable selection below:

- 2023 2nd quarter Earnings – Tilray Brands, Inc. 2023-04-10

- 2023 2nd quarter Earnings – Yamana Gold Inc 2023-04-10

- 2023 2nd quarter Earnings – Pricesmart 2023-04-10

- 2023 2nd quarter Earnings – Albertsons Companies 2023-04-11

- 2023 2nd quarter Earnings – Bed Bath & Beyond Inc 2023-04-11

- 2023 2nd quarter Earnings – Taiwan Semiconductor 2023-04-12

- 2023 2nd quarter Earnings – Platinum Group Metals Limited 2023-04-12

- 2023 2nd quarter Earnings – Tesco Plc 2023-04-13

- 2023 2nd quarter Earnings – Infosys Limited 2023-04-13

- 2023 2nd quarter Earnings – Propertyguru Group 2023-04-13

- 2023 2nd quarter Earnings – Bang & Olufsen A/S 2023-04-13

- 2023 2nd quarter Earnings – Byd Company Limited 2023-04-13

- 2023 2nd quarter Earnings – Delta Air Lines, Inc. 2023-04-13

- 2023 2nd quarter Earnings – Unitedhealth Group Incorporated 2023-04-14

Below is a sample of the automated timelines on Capnote which can shows even more events.

High Performers Of The Week 🚀

Global Indicators

- Coal +9.31%

- Coffee +7.68%

- Crude Oil (WTI) +6.65%

Industries

- Government Contractor +13.24%

- Healthcare +5.16%

- Internet technologies +3.66%

Companies Over $10 Billion In Market Cap

- Teck Resources +20.47%

- Agnico-Eagle Mines Ltd. +10.93%

- Beigene +10.63%

Companies Below $10 Billion In Market Cap

- Inflarx +183.62%

- Secoo Holding +102.38%

- Guardforce Ai Co +80.41%

Deepen your expertise about key operating metrics with CFI’s dedicated accounting programs such as the “Financial Analysis Fundamentals” course.

Low Performers Of The Week 🚩

Global Indicators

- UK Gas -13.32%

- TTF Gas -9.43%

- Natural gas -9.25%

Industries

- Space Logistics -22.23%

- Energy Storage -9.54%

- Pipelines -9.05%

Companies Over $10 Billion In Market Cap

- Nio Inc. -14.27%

- Marketaxess Holdings Inc -12.27%

- Albemarle Corporation -11.93%

Companies Below $10 Billion In Market Cap

- Oncternal Therapeutics -65.08%

- Oncosec Medical, Incorporated -57.14%

- Vbi Vaccines -54.79%

View more on Capnote.