Hello,

It’s another week and another edition of Capnote’s weekly spotlight newsletter. Below, we look into uncommon data trends from the markets that will help you impress and outperform. View our past newsletters on the Capnote blog page.

- This week our spotlight falls on steel, the important alloy that is used for virtually everything in the modern world. It’s widespread usage means that price increases can fuel inflation. However, steel prices have fallen 40% from all time highs in 2021. As governments invest in infrastructure and the bull case for steel strengthens, is it a welcome opportunity for investors or a significant risk for the fragile economy? Read more below.

- Over the last week, Bitcoin gained +9% and continued to defy its numerous skeptics. The S&P 500 was slightly up +0.79%, US 10 year treasury yields increased by 3% and crude oil rose another 2%. The US dollar continued its slide with the US dollar index losing -0.50%. A weaker dollar is often seen as a bullish signal for US exports and the stock market. Earnings of big bank stocks exceeded expectations as they benefitted from the depositor flights to safety due to the banking crisis.

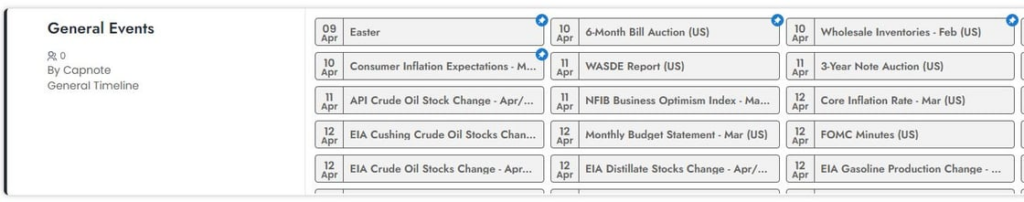

- The coming week is a significant earnings week with industry leaders such as Tesla, Abbott, American Airlines, Netflix, IBM, Cleveland Cliffs and others releasing quarterly reports. Cleveland Cliffs’ earnings will be particularly interesting this week as our focus is on steel prices. Analysts have been expecting earnings to begin to show signs of deterioration as the economy slows due to rate hikes, credit tightening and layoffs. Go to the Timelines & Events section on Capnote for more.

Sign-up and join Capnote – the modern productivity platform for financial professionals and investors. You’ll get access to patented automation and machine learning technology, global datasets and a growing professional community.

Quote of the Week

“If the world economy gets better, commodities are very good place to be in… even if the world economy does not improve, commodities are still a fabulous place to be.”

– Jim Rogers (Commodity Guru)

Spotlight 💡🔦

Steel is essential to modern life. The alloy is used in almost every industry including construction, infrastructure, industrial tools, machinery, manufacturing, automotive, aerospace and more. The US chamber of commerce has even labelled it to be “critical for national security and the minimum operation of the economy and government”. Given its importance and wide spread usage, its clear that higher steel prices can fuel inflation. With steel prices up 15% since October 2022 and key providers such as Cleveland Cliffs and Nucor announcing price increases, will steel hinder the Fed’s fight against inflation? The chart below from Trading Economics, shows a 10 year trend of steel prices, which have been cyclical and volatile.

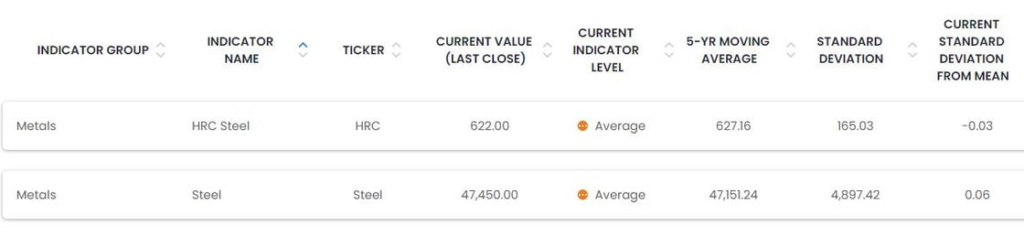

The below extract from Capnote’s indicators page shows that current prices of steel are average relative to their 5 year history. Following the pandemic and all time highs reached in 2021, steel prices have normalized by falling 40% and are now delicately poised for a break higher or lower in line with competing forces.

The bullish case for steel includes the significant focus on infrastructure by many governments across the world such as the US, India, China and others. In the US, the infrastructure and jobs act plans for $1.2 trillion in spending over the next 5 years on infrastructure projects such as rail, power and broadband access. India plans to invest $1.5 trillion in infrastructure over the next decade, as highlighted in this article by S&P. In the US, some steel producers have announced price increases. This suggests pricing power and perhaps even an abundance of demand over supply. There also continue to be tariffs on steel imports, which have been deemed to be a US national security threat. Whilst more countries have recently been excluded, these tariffs still offer some protection to domestic producers and limit supply.

There is also a bearish case for steel in which the global macroeconomy suffers a slowdown due to rate hikes, reduced consumer spending and subsequently a fall in industrial output. However, with many of the planned infrastructure projects being sponsored by Governments, it is arguable that they may proceed regardless of the state of the economy. Amidst these competing forces, the price of steel appears to be in for an interesting and volatile period. Investors that have the stomach to explore this opportunity will need to strap in tight. Financial professionals are well placed to help industrial consumers hedge and minimize their downside whilst helping steel producers prepare to lock-in higher prices, if that scenario occurs. Along with many other analysts, we will be listening intently to the earnings call for Cleveland Cliffs which will undoubtedly present a few clues.

Timeline Updates ⏰

Earnings events continue this week with a notable selection below:

- 2023 2nd quarter Earnings – Lockheed Martin Corporation 2023-04-17

- 2023 2nd quarter Earnings – United Airlines Holdings, Inc. 2023-04-18

- 2023 2nd quarter Earnings – Tesla, Inc 2023-04-18

- 2023 2nd quarter Earnings – Netflix, Inc. 2023-04-18

- 2023 2nd quarter Earnings – Snap Inc. 2023-04-19

- 2023 2nd quarter Earnings – Abbott Laboratories 2023-04-19

- 2023 2nd quarter Earnings – Kinder Morgan, Inc. 2023-04-19

- 2023 2nd quarter Earnings – Nextera Energy, Inc. 2023-04-19

- 2023 2nd quarter Earnings – American Airlines Group Inc. 2023-04-19

- 2023 2nd quarter Earnings – IBM Corporation 2023-04-19

- 2023 2nd quarter Earnings – Baker Hughes Company 2023-04-19

- 2023 2nd quarter Earnings – Tractor Supply Company 2023-04-19

- 2023 2nd quarter Earnings – Cleveland-Cliffs Incorporated 2023-04-20

- 2023 2nd quarter Earnings – Wh Smith Plc 2023-04-20

- 2023 2nd quarter Earnings – Taiwan Semiconductor. 2023-04-20

- 2023 2nd quarter Earnings – The Procter & Gamble Company 2023-04-20

- 2023 2nd quarter Earnings – Schlumberger N.V. 2023-04-21

Below is a sample of the automated timelines on Capnote which can shows even more events.

High Performers Of The Week 🚀

Global Indicators

- ETH/USD +12.65%

- Germany 10Y +11.46%

- BTC/USD +9.17%

Industries

- Digital & Cryptocurrency +46.00%

- Photography & Art +6.50%

- Wood products +6.33%

Companies Over $10 Billion In Market Cap

- Posco Holdings Inc +14.87%

- Coinbase Global +13.79%

- Bio-Techne +12.68%

Companies Below $10 Billion In Market Cap

- Saitech Global Corp +305.13%

- Inpixon +173.91%

- Marpai +117.39%

Deepen your expertise about key operating metrics with CFI’s dedicated accounting programs such as the “Financial Analysis Fundamentals” course.

Low Performers Of The Week 🚩

Global Indicators

- Baltic Dry -6.22%

- TTF Gas -4.58%

- Lean Hogs -3.44%

- Steel -2.45%

Industries

- Saitech Global Corp +305.13%

- Inpixon +173.91%

- Marpai +117.39%

Companies Over $10 Billion In Market Cap

- Sarepta Therapeutics, Inc. -13.97%

- Baidu, Inc. -11.20%

- Ke Holdings -9.64%

Companies Below $10 Billion In Market Cap

- Pear Therapeutics -67.91%

- Viewray -58.74%

- Professional Diversity Network -50.63%

View more on Capnote.