Hello,

Welcome to another edition of Capnote’s weekly spotlight newsletter, where we look into uncommon data trends from the markets that will help you impress and outperform. View our past newsletters on the Capnote blog page.

- This week our spotlight falls on the continued fall in natural gas prices and potential impact on consumers, purchasing industries and countries. With sentiment supporting the ramp up of nuclear power in countries such as Japan, could we be in for an extended period of lower natural gas prices? What would be the implications to industry and consumers? Read more below.

- Over the last week, crude oil prices fell by over 5%, the S&P 500 was largely flat with a -0.1% change, gold fell by -0.4% and bitcoin dropped by over -10%. The EU put in place the first ever carbon tariff in which foreign companies that haven’t paid for carbon emissions at home will have to pay a tariff when exporting goods to Europe. The impact of this on trade and the price of goods in Europe will be worth close monitoring.

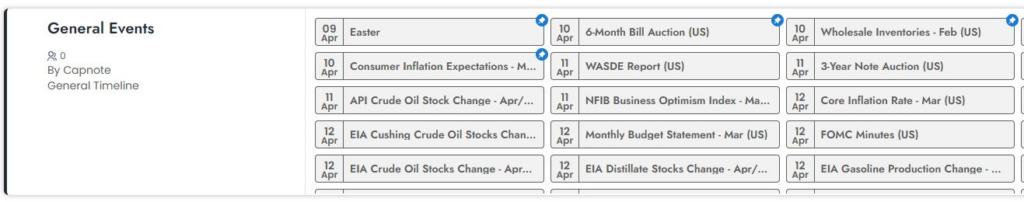

- In the coming week earnings for Apple, Amazon, McDonalds, Coca Cola and PepsiCo will given significant clues as to the state of the overall economy and direction of the market as we approach H2. Boeing and Raytheon’s earnings may also reflect the increasing geo-political tensions felt across the world. Go to the Timelines & Events section on Capnote for a complete list of the week’s upcoming events.

Sign-up and join Capnote – the modern productivity platform for financial professionals and investors. You’ll get access to patented automation and machine learning technology, global datasets and a growing professional community.

Quote of the Week

“The consensus call is gas is dead until late 2024, early 2025. It’s hard to point to anything different until the large LNG projects start to come in late next year.”

– Neal Dingmann, Truist Securities

Spotlight 💡🔦

Natural gas is often referred to as the world’s primary energy source. It is cleaner for the environment than coal or oil and can be found abundantly across the world. Amidst the pandemic and the war in Ukraine, there are few commodities that have been as parabolic as natural gas. The below 10 year price chart from Trading Economics illustrates this clearly. From 10 year highs in August 2022, prices have fallen by -76% in less than a year. Reasons for this include warmer than expected weather, lower demand in Asia and the increasing sentiment in support of nuclear power in countries such as Japan and South Korea. According to the Institute for Energy Economics and Financial Analysis, nuclear reactor restarts in Japan could eliminate 6 million tons in annual LNG demand which was 8% of Japan’s annual imports for 2022.

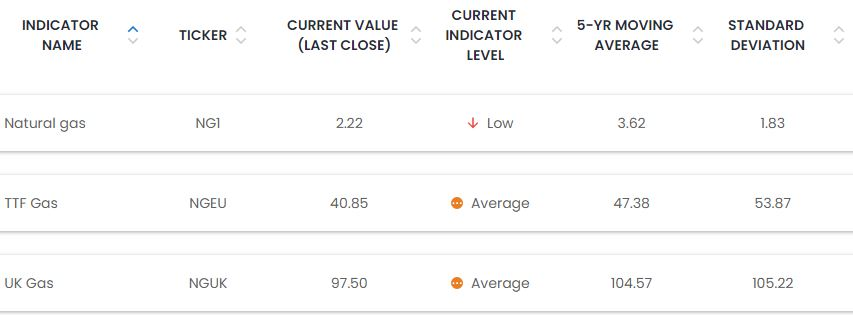

The below extract from Capnote’s indicators page shows that the prices of natural gas variations relative to their 5 year history. European variations of natural gas such as TTF are trading slightly higher than Henry Hub.

Given the broad array of uses for natural gas, lower prices for an extended period will have significant implications:

- The opportunity for lower costs in industries which require natural gas as a feedstock such as power generation, heating, chemicals and fertilizers. As precedent, one chemicals producer highlighted the impact of low natural gas prices in 2016 and estimated savings of $11 billion annually across chemicals producers in the US.

- There will be negative implications for competing industries such as coal. Coal producers benefitted significantly from the shortage of natural gas as coal power plants were fired up to make up the difference. However, with natural gas prices low, coal has again moved lower down the list of preferred energy sources. It is unclear what impact this will have on renewable energy given government incentives and intervention.

- Countries that are typically large importers of natural gas such as India, China and Japan will benefit from reduced use of their foreign exchange reserves. Some countries are also using this opportunity to secure long term sources of energy. For example, Mitsui of Japan recently purchased a controlling 92% stake in a natural gas field in Texas which has connections to LNG exporting terminals and ammonia production plants.

Note that the above implication do not immediately point to stock movements and may also have other implications which may not be complementary. For example, in the chemicals industry, there may be lower costs but a heightened risk of overproduction across the industry leading to lower income for chemicals producers.

Timeline Updates ⏰

Earnings events continue this week with a notable selection below:

- 2023 2nd quarter Earnings – Coca Cola Company 2023-04-24

- 2023 2nd quarter Earnings – Whirlpool Corporation 2023-04-24

- 2023 2nd quarter Earnings – General Electric Company 2023-04-25

- 2023 2nd quarter Earnings – Novartis Ag 2023-04-25

- 2023 2nd quarter Earnings – Raytheon Technologies 2023-04-25

- 2023 2nd quarter Earnings – Mcdonald’S Corporation 2023-04-25

- 2023 2nd quarter Earnings – Pepsico, Inc. 2023-04-25

- 2023 2nd quarter Earnings – General Motors Company 2023-04-25

- 2023 2nd quarter Earnings – Verizon Communications Inc 2023-04-25

- 2023 2nd quarter Earnings – Roku, Inc. 2023-04-26

- 2023 2nd quarter Earnings – Meta Platforms, Inc. 2023-04-26

- 2023 2nd quarter Earnings – The Boeing Company 2023-04-26

- 2023 2nd quarter Earnings – Apple Inc. 2023-04-26

- 2023 2nd quarter Earnings – Amazon.Com, Inc. 2023-04-27

- 2023 2nd quarter Earnings – Hershey Company 2023-04-27

- 2023 2nd quarter Earnings – Intel Corporation 2023-04-27

- 2023 2nd quarter Earnings – Cloudflare, Incorporated 2023-04-27

- 2023 2nd quarter Earnings – Exxon Mobil Corporation 2023-04-27

- 2023 2nd quarter Earnings – Sony Group Corporation 2023-04-28

- 2023 2nd quarter Earnings – Chevron Corporation 2023-04-28

- 2023 2nd quarter Earnings – Mitsubishi Electric Corporation 2023-04-28

Below is a sample of the automated timelines on Capnote which can shows even more events.

High Performers Of The Week 🚀

Global Indicators

- Tin +8.40

- Platinum +8.28

- Palladium +7.30

Industries

- Scientific Research +34.19%

- Installations & Inspections +8.13%

- Glass +6.08%

Companies Over $10 Billion In Market Cap

- Legend Biotech +31.46%

- Intuitive Surgical, Inc. +12.44%

- Samsara +11.25%

Companies Below $10 Billion In Market Cap

- Presto Automation +159.66%

- Eyepoint Pharmaceuticals +107.88%

- Bellus Health Inc. +104.39%

Deepen your expertise about key operating metrics with CFI’s dedicated accounting programs such as the “Financial Analysis Fundamentals” course.

Low Performers Of The Week 🚩

Global Indicators

- ETH/USD -11.97%

- BTC/USD -10.53%

- Gasoline -8.21%

Industries

- Digital & Cryptocurrency -23.29%

- Drilling & Mining -6.94%

- Automotives -6.23%

Companies Over $10 Billion In Market Cap

- Coinbase Global -15.55%

- Albemarle Corporation -14.83%

- Cdw -12.75%

Companies Below $10 Billion In Market Cap

- China Jo-Jo Drugstores -79.61%

- Virnetx Holding -63.17%

- Marpai -56.75%

View more on Capnote.