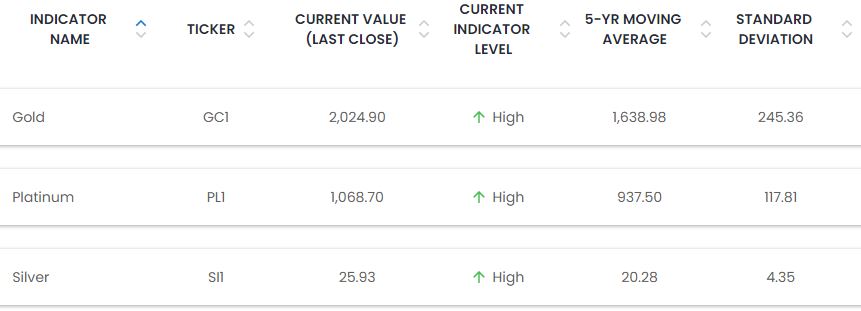

Precious metals are booming. The below indicators function on Capnote shows that the prices of Silver, Platinum and Gold are all at high levels and greater than their 5- year averages by more than one standard deviation. This is generally being driven by inflation as well as fearful investor and central bank sentiment about the global economy.

In 2020, silver prices were on a rollercoaster as can be seen in the below 5 year chart from Trading Economics. Silver prices dropped to 5 year lows due to a drop in industrial demand related to COVID shutdowns. Then silver prices increased to 5 year highs as fearful investors piled into precious metals. There have also been supply shocks with a number of mining project facing shutdowns across the world.

It is estimated that over 60% of demand for silver comes from industrial uses while 40% comes from investor activity and jewellery. As such, Silver prices look set to continue their rally and perhaps remain higher for longer. Below are 3 reasons that support this theory.

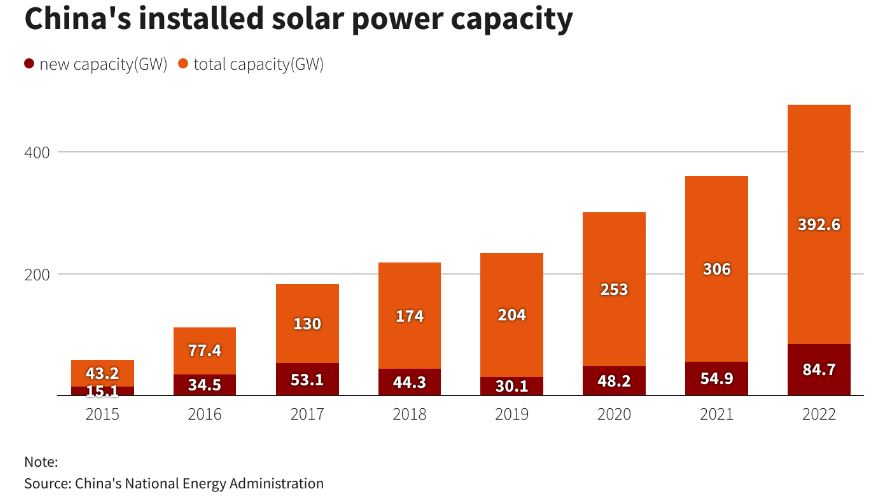

1. There is increasing investment in renewable energy. Silver is used widely in photovoltaic cells used in solar panels. Higher oil and gas prices have refocused global leaders on the need for energy security, leading to an increase in solar investment. For example, China’s is expected to post record annual increases in its solar capacity in 2023 with capacity additions of up to 120 gigawatts. There have also been project announcements by the UK, US, India, Australia and France such as the One Sun, One World and On-Grid initiative.

2. Ongoing electrification and digitization of the world. An example of this is the current push for greater use of electric vehicles. Silver is used in electric vehicle batteries and electronics such as smart phones. With China emerging from lockdowns, recent economic releases report an increase in industrial activity, causing some analysts to increase their GDP growth forecasts for the year. According to the Silver Institute, global silver demand has exceeded supply since 2020 with mine’s recording a shortfall in production.

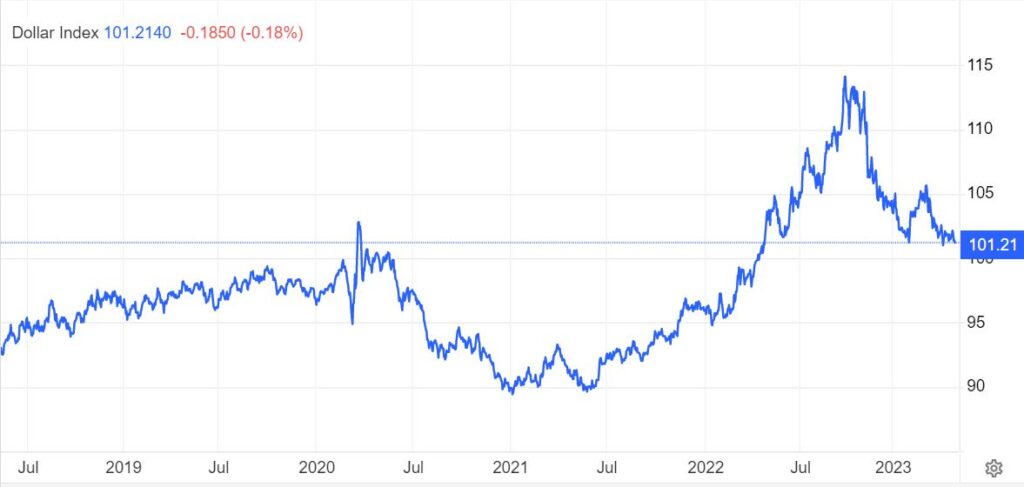

3. Silver is considered to be a safe haven asset. As the dollar weakens, inflation persists and concerns grow about a banking crisis or macroeconomic slowdown, investors are turning to safe havens such as silver for value preservation. In the below Dollar Index chart from Trading Economics, it is clear to see the recent fall in dollar value. However it is still relatively high compared to its 5 year history. When the dollar weakens, there is generally an upward pressure in demand for commodities such as silver.

Sign up to Capnote and review our indicators section to actively track silver prices. Read more below from: