This week, our spotlight falls on the price of rice, a staple food for over 3.5 billion people which is almost half of the world’s population. As shown in the below extract from the Capnote indicator dashboard, Rice prices are currently at ‘very high’ levels when compared to its 5 year average and standard deviation. Fitch Solutions expects the price of rice to remain high until 2024. However at the same time, prices for grains and soybeans are in decline and considered low. So what’s behind this apparent disconnect across these agricultural commodities and how does this impact us?

The below chart from Trading Economics shows the 5 year price trend for Rice as a traded commodity. In 2020, Rice prices spiked to 10 year highs as the coronavirus pandemic led to labor shortages and spurred panic stockpiling as well as export restrictions from some producing nations. Since that time, despite the end of the pandemic, rice prices have once again crept up and are approaching pandemic highs.

Reasons for this are due to both demand and supply side factors.

- Supply Factors: According to Fitch Solutions, rice production is having its largest shortfall in 20 years. This is being driven by adverse weather conditions in countries like China and Pakistan. A scientific study has shown rice is one of the most vulnerable crops during El Nino type weather events. With El Nino related weather events expected to happen more often out to 2040, rice prices may experience high levels of volatility.

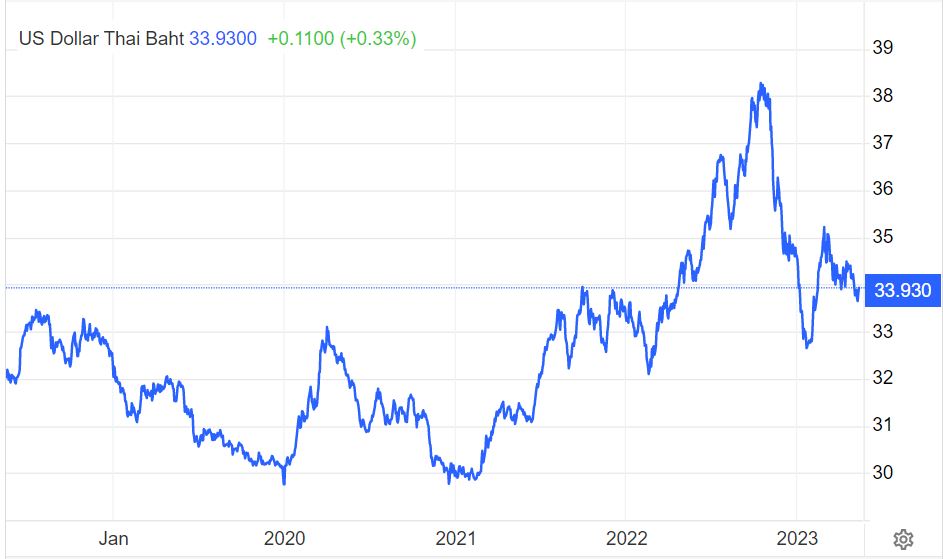

- Demand Factors: Rice is being used as a replacement for wheat, which has constrained supply given the ongoing war between Russia and Ukraine. Strengthening of the Thai Baht against the US dollar has also meant that rice prices denominated in USD will increase.

Implications of high prices of rice are widely experienced given regular consumption by over half of the world’s population. The UN has also stated this heightens the risk of food insecurity for masses of people.

- Countries that are large importers will feel the associated increase in costs the most in the form of inflation, balance of payments outflows and potential currency weakening. Some of the biggest importers of rice include China, the EU, USA, Saudi Arabia, Japan, the Philippines, Mexico, Côte d’Ivoire, Senegal, Nigeria, Iraq and others.

- Countries that are large exporters of rice could see higher balance of payments inflows and the potential strengthening of their currency (also subject to other factors). The largest exporters of rice include India, Thailand, Vietnam, Pakistan, China, Brazil, Cambodia and others.

- For your clients and investments in the Agriculture, Food and Retail industries, it is important that you check if rice is an essential input in their operations. If it is, can you determine their ability to pass prices on consumers? If they have little to no pricing power, then earnings could be negatively impacted. Chipotle is one restaurant chain that seems to have proven its ability to pass higher costs onto consumers. Its stock is up 15% in the last month on strong earnings. Download Capnote’s one-click data report about the company for free.

Capnote’s industry feature helps you keep track of industries in different regions and look into related performance and characteristics.