What is El Nino?

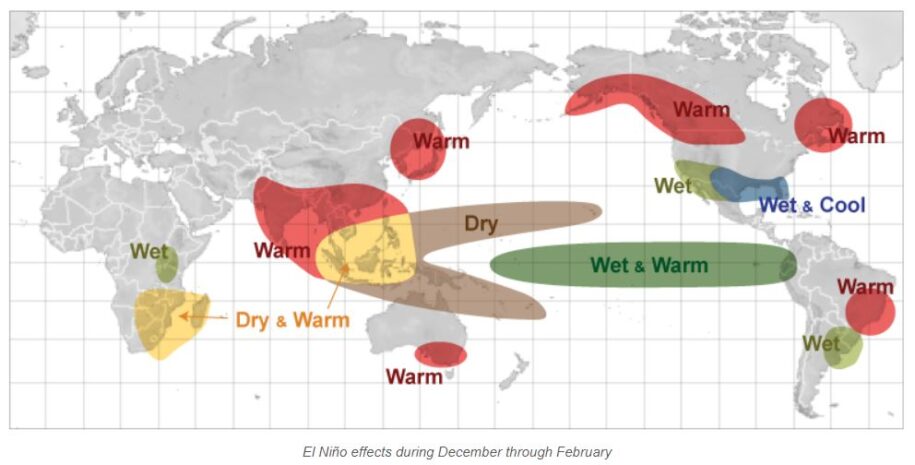

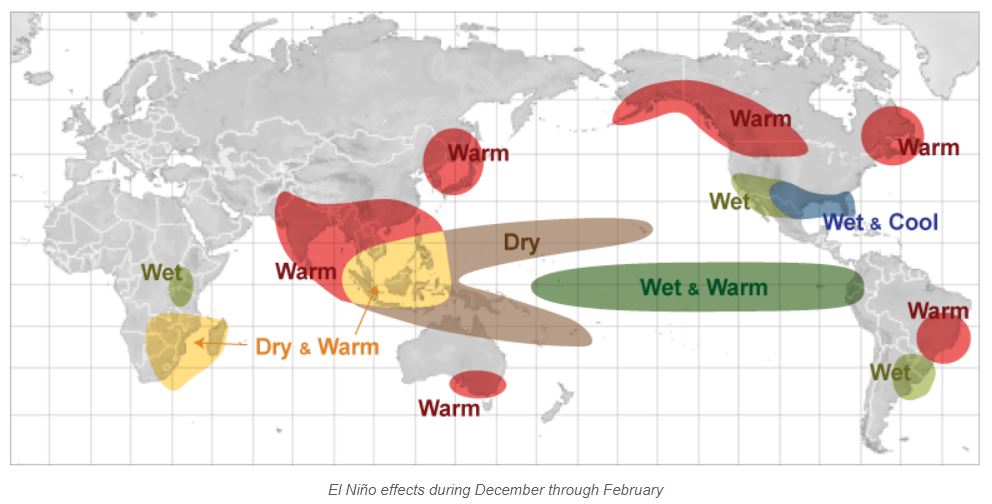

El Nino may sound like the name of a popular mariachi band, but it is in fact a repeated weather formation that costs the global economy $3 trillion in losses on average. According to the National Geographic Society, “El Nino is a climate pattern that describes the unusual warming of surface waters in the eastern tropical Pacific Ocean.” This phenomenon typically leads to dryer, warmer weather and even flooding in large swaths of the world. The below map from the National Weather service illustrates expected weather patterns due to El Nino

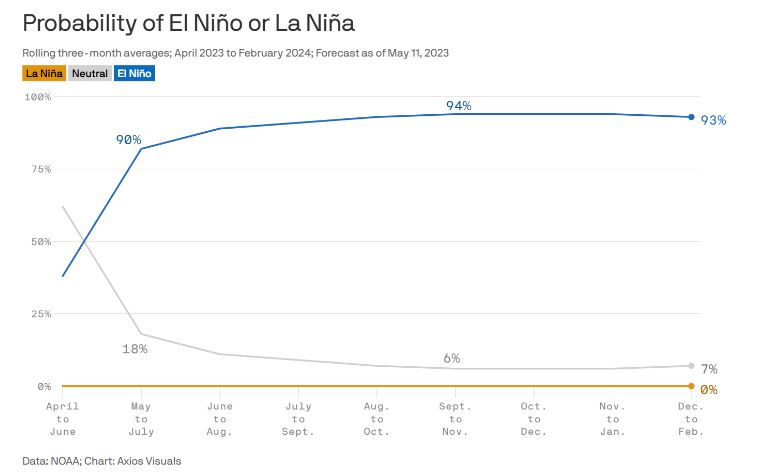

The chart below from Axios shows the National Oceanic and Atmospheric Administration (NOAA) estimates a high and increasing probability of El Nino occurring between April 2023 and February 2024. The World Meteorological Organization (WMO) predicts an 80% chance of occurrences of El Nino events between July and September 2023. While it is difficult to be precise, these experts suggest there is a high likelihood of El Nino happening in the next couple of months.

Potential Implications of El Nino On Industry

El Nino is expected to occur every 5-10 years, with the last occurrence about eight years ago in 2015-16. The El Nino events of 1982–1983 and 1997–1998 were the most intense of the 20th century. They led to harsh droughts in Australia, Indonesia, Malaysia, and the Philippines. In addition, during this period, a typhoon was experienced in Tahiti, flooding occurred in Chile and Peru, and record-breaking temperatures occurred in some parts of the US. Below are some implications to watch out for.

- Travel & Tourism: Empirical evidence has shown that El Nino has adversely impacted tourism interest and numbers in the past. For example, in California, El Nino led to torrential rains that reduced visits to amusement parks, zoos, and activities like whale-watching cruises. Global tourist attractions in South America, like the Galapagos Islands in Ecuador, faced risks as El Nino had significant effects on wildlife and the severe weather dampened tourist numbers. Reductions in the levels of tourism can have knock-on effects on other industries such Aviation, Hospitality & Lodging, Entertainment, and others.

- Insurance: El Nino is typically accompanied by drought and flooding. It could lead to large catastrophic events and losses. This could directly impact the probability and magnitude of insurance claims as well as drive up the cost of insurance. A paper from the American Meteorological Society shows that 1% of extreme events, covering wide spatial areas, caused over 66% of total insured losses. This implies that insurance companies with large concentrations in El Nino “red-zone” areas are at higher risk of claims. Further, insurance companies could be at high risk of adverse selection as companies expecting to be affected by El Nino will seek to sign contracts around these times.

- Renewable Energy: The occurrence of previous El Nino events has been reported to weaken wind speeds and lead to declines in wind-generated power. In addition, research from Michigan State University shows that solar energy generation also suffered some declines during periods of El Nino due to increased cloud cover in some solar farm locations. In addition, flooding, mudslides, and debris deposits could negatively impact the efficiency of solar and wind farm locations. This means that renewable energy companies as well as those dependent on them could start bracing for the implications of possible declines in energy production and production efficiency from El Nino.

- Grains and cash crops: Using observations from the last El Nino, grains and cash crops saw an uptick in prices due to supply disruptions in different parts of the world. For instance, in Australia, El Nino led to increased bushfires, a significant reduction in wheat export volumes, and hikes in global wheat prices. For context, Australia is one of the top five largest global exporters of wheat. In another instance, Indonesia and Malaysia account for over 80% of the world’s palm oil exports. El Nino-induced droughts led to disruptions in supply and pushed up global prices for the commodity. In Brazil, the largest exporter of coffee globally, El Nino could cause overflooding of regions with coffee plantations, dampen yield, and disrupt global supply. All these imply a heightened risk of disruption of inputs on the horizon for companies in the FMCG industry, ranging from companies in flour milling, beauty products, and beverage sub-industries.

- Commercial Fishing: Research has shown that El Nino led to declines in fish catch in commercial fisheries in regions including the North Pacific and East China Sea. This happens by reducing plankton abundance due to weakened upwelling conditions, resulting in less prey for fish. If these events occur, fish prices could go up and cause adverse demand and limit the growth of the global fishing industry.

El Nino will have a ripple effect on several more industries and countries around the world. Financial professionals and investors should be evaluating portfolios of clients or investments for risks and potential opportunities. It is essential to objectively assess strategies that the companies in your portfolio are preparing in response to climate change, extreme weather and other ESG issues. There may also be opportunities related to infrastructure development, alternative foods and nuclear power. Capnote has resources to help you track risk factors for industries and companies you have exposure to.

Written by Ikenna Ene and Shakirat Anifowoshe