US – China tensions have continued to ramp up across military, industrial and financial lines. Last week, China banned government officials from using iPhones. This caused Apple’s shares to lose $200 billion in value. The rout even dragged in some of Apple’s suppliers such as Qualcomm. These events have caused nervous scrambling as analysts check and adjust their portfolios for geopolitical risk. The below list from Investors Business Daily highlights 10 companies in the S&P 500 with significant exposure to China. Notably the majority of these are in the technology sector.

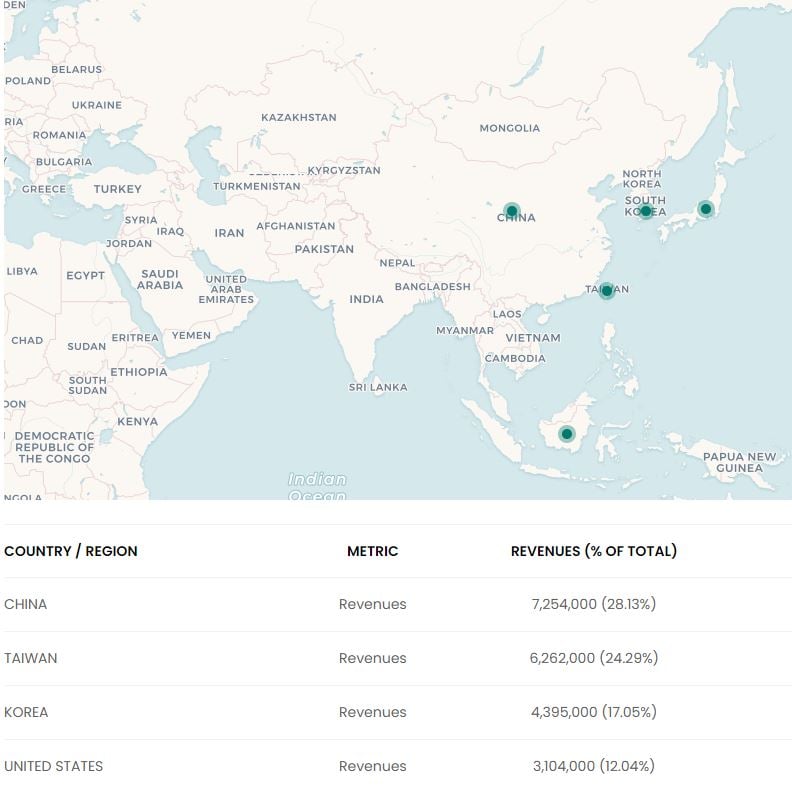

As financial professionals or investors, it is best practice to understand the geographic exposure in your portfolios. However, this can be a tedious exercise with constantly changing data. Save time when checking for geographic exposure by using Capnote. Search for a company, go to Geographies & Maps and then use the filters to select ‘Revenue’ or ‘Subsidiaries’. You will then see a map and table with geographic revenue exposure as reported by the company.

Save time and increase your awareness so you aren’t caught out by surprise by geo-political risks. Try this for yourself by signing up to Capnote for free.

Written by Ikenna Ene