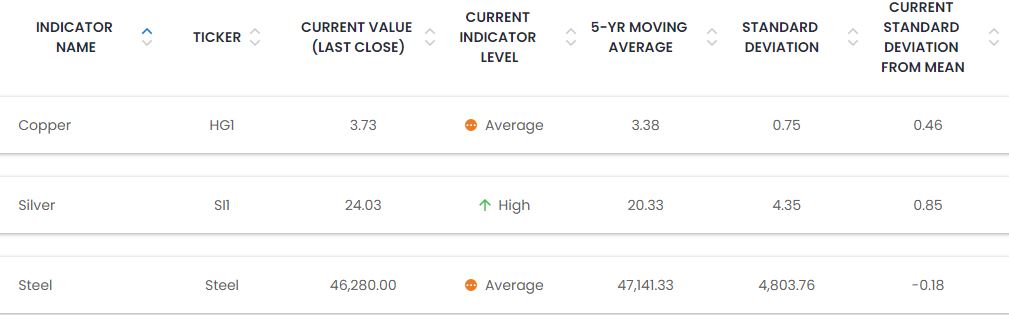

This week our spotlight is on copper, which is also known to some as the eternal metal because it is easily recycled without losing any of its properties. Thus far in 2023, the price of copper has fallen to its lowest levels year to date. The below extract from Capnote’s indicators page shows that when observed over the long term, current prices are close to 5 year averages, similar to a few other industrial metals.

The below 5 year chart from Trading Economics shows the rapid rise in prices over 2020 – 2022 and the ongoing current weakness. These upward and downward movements seem to be closely associated with the state of industrial activity in the Chinese economy. You may wonder how copper is related to signs of slowing industrial output in the world’s second largest economy?

The fall in Copper prices has been largely attributable to the lower-than-expected industrial output and retail sales data reported for the Chinese economy. China is the world’s largest consumer of refined copper accounting for over 50% of the volume of copper consumed, followed by Europe and America. Although China is also among the top 5 producers of copper, it needs way more copper than it produces because it is the world’s manufacturing hub. Copper’s characteristics make it a top choice for the production of computer circuitry, electrical wires and almost all electronic devices such as TVs, computers, kitchen appliances, cell phones and even electric vehicles. Hence, signs of a possible slowdown in industrial output in the Chinese economy are likely to put in a dent in the price of copper.

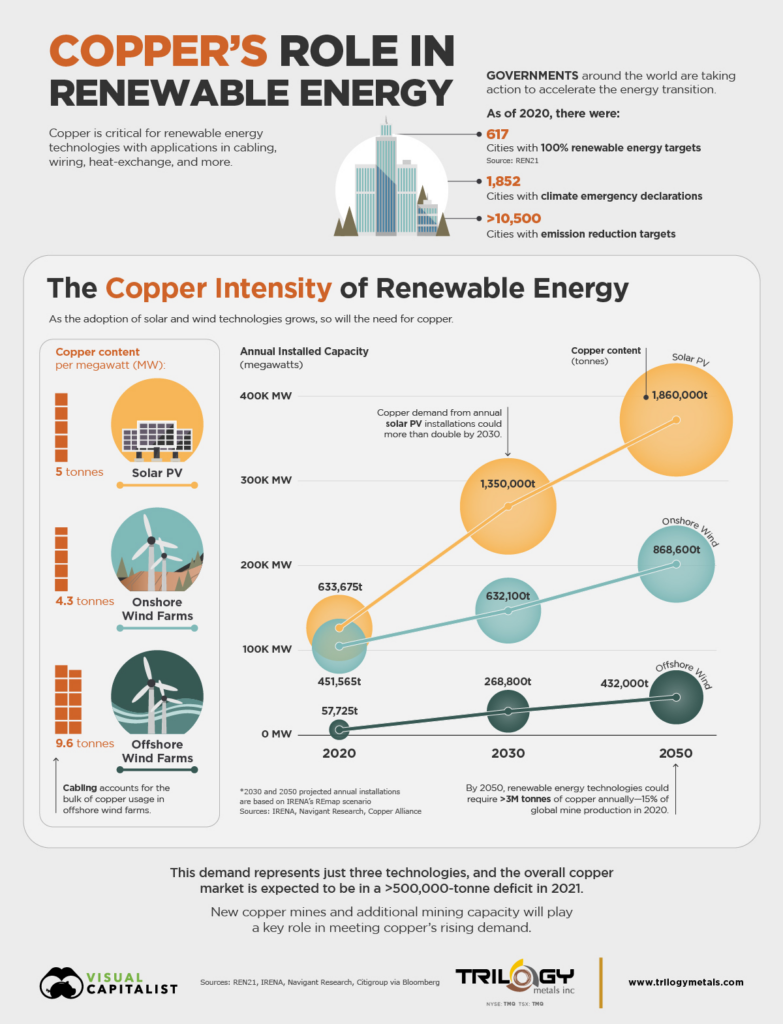

Lower copper prices are not the end of the story. The world is going through significant changes that fundamentally support the increased use of copper such as the energy transition. Read more below to see a great visual highlighting the copper intensity of renewable energy from the Visual Capitalist.

The Bull Case For Copper

- Copper has a key role to play in the world’s transition to sustainable sources of energy. It can be endlessly recycled without losing its characteristics and also has high thermal and electrical conductivity. For these reasons, it has become essential for the production of renewable energy and electric vehicles. As the world continues to reduce its reliance on fossil fuels, copper will be in high demand for use in wind turbines, solar panels and renewable energy transmission.

- The ongoing digitization and electrification of the world also implies significant copper usage. Following the COVID-19 pandemic, the IMF mentions that digitization across advanced economies increased by an average of 6%. This is also likely to increase with the spread of artificial intelligence and robotics. Copper demand is likely to increase given it is used in the manufacturing process for electronic devices and electric transmission.

- The supply of copper appears to be approaching a peak. Chile, DR Congo and Peru lead the world in copper mining. The growth in production of copper has stuttered in the last few years and is expected to remain challenged. This means low supply of mined copper amidst the expectation of continuously high demand.

However, it’s important to note there are other factors that could influence the direction of copper prices in the short or long term. For example, Copper can be recycled continuously without losing its properties. As recycling increases, supported by environmental trends and the drive for sustainability, the supply of recycled copper is likely to increase. Holding other factors constant, this could imply more supply of the red metal and create price volatility. There could also be technological developments which enhance copper mining output. It is important to keep track of industry developments.

Written by Ikenna Ene and Shakirat Anifowoshe