This week our spotlight is on wheat, a critical ingredient in the manufacturing of beverages such as beer as well as the production of animal feed. The past year has been one of intense volatility for wheat prices. The below 10-year chart from Trading Economics shows its incredible rise to all time highs in March 2022, driven by the Russia Ukraine war, especially because Russia is the world’s largest exporter of wheat. The subsequent steep correction in wheat prices is due to easing of supply constraints due to the Black Sea grain deal which allowed trapped supplies to re-enter the market.

What’s Next For Wheat Prices?

Supply side influences appear to be responsible for volatility so far. This summer two important factors to keep an eye on include the Black Sea initiative and El Nino, a brewing pattern of harsh weather. More on these below:

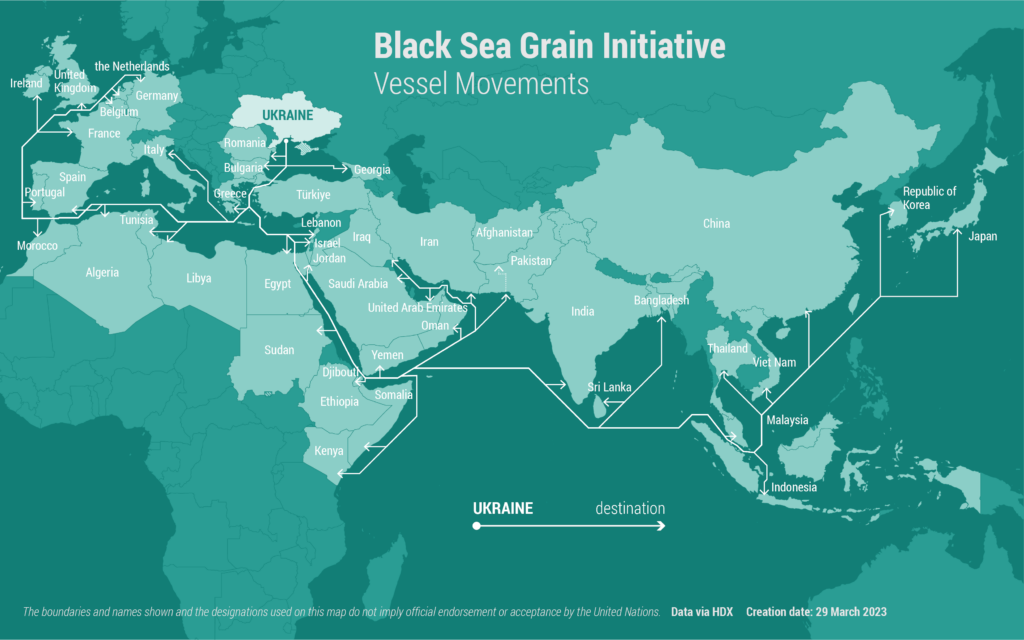

- The Black Sea Grain Initiative is an agreement brokered by the United Nations between Turkey, Russia, and Ukraine to enable a safe maritime movement of grain exports through the Black Sea. European Union countries plus Turkey, Russia, and Ukraine comprise a significant portion of global wheat production (and consequently exports). At the onset of the Russia-Ukraine conflict, wheat prices spiked significantly due to the shock of a shortage of supply. However, the initiative has provided some succor to global supply and contributed to the moderation in prices. The deal is scheduled to be renewed on 17 July 2023. On 17 May, the United Nations announced that Russia had agreed to extend its participation for 60 days. However, Russia has also stated it would withdraw if its demands are not met. If this deal does not hold, the price of wheat is expected to spike again.

- El Nino: This is a global climate pattern that leads to dryer, warmer weather in some regions and flooding in others. It is repeated every 3-7 years on average. There is an expected 90% probability of El-Nino at the end of 2023, through winter and into 2024. Depending on the intensity of El Nino, we could witness significant disruptions to wheat production in many non-European producing countries. A research paper published in 2017 concluded, “At the global level, El Niño events have negative impacts on wheat yields (especially during the first semester), with Australia experiencing the highest negative impact.”

Potential Implications of Wheat Price Volatility

Most of the world’s wheat production hangs in the balance between the two important factors discussed above. According to experts, they both appear to have decent probabilities of occurring. If wheat supply is impacted and prices spike, below are some potential implications:

- Production of your favorite beverages and related manufacturers face risks : Wheat is a key ingredient in the production of alcoholic and non-alcoholic beverages. The interplay of these two factors will not only influence the volume of wheat supply available around the globe but also the prices that beverage manufacturers will pay. Beer has often been thought to be recession proof. However, inflation earlier in the year saw beer manufacturers pass on costs to consumers. According to the U.S. Bureau of Labor Statistics (BLS). The Consumer Price Index (CPI) for beer at home (+6.1%) outpaced overall inflation (+5%) in March 2023. As a result, consumers are purchasing less beer. This has risks for beer manufacturers such as Constellation Brands who recently recorded an impairment charge of $66.5 million associated with negative trends in the craft beer market. This could create actionable concern for risk managers, portfolio managers and investors.

- Fancy steak dinners could be replaced by fast food: Wheat is essential in the production of animal feeds for livestock. Spikes in the price of wheat directly impact feed costs and lead to more expensive beef prices. When the cost of feeding cattle escalates significantly, farmers could even be forced to strategically cull their herd to save money. Last year, when there was stress on supply in the grain market due to the Russia-Ukraine war, farmers shrank their cattle herds. This led to increases in the price of beef and related products on shelves. With the beef market not yet fully recovered from the last shock, fresh pressure on prices could have a pronounced effect across the value chain. Food companies and restaurants may be forced to test their pricing power. Over the last couple of months, non-premium fast food companies such as Chipotle have seen an increase in orders.This suggests that in periods of inflation customers forego premium restaurant meals in favor of cheaper options. As of 29 May 2023, Chipotle’s stock is up 51% year to date and Shake Shack is up 56%.

Written by Ikenna Ene and Shakirat Anifowoshe