Capnote – Corporate Treasury (Private Platform)

Corporate Treasury

To make the best financial decisions possible, corporations have to collaborate across treasury, corporate finance, strategy and business development teams.

The Capnote Private Platform is an automation and productivity engine that has been designed to help Corporate Treasury and Strategy teams save time, collaborate and enhance the quality of their analysis.

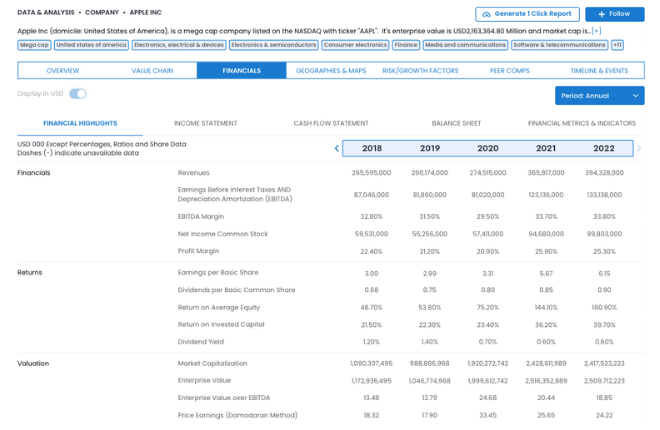

Comprehensive Data & News

Receive access to comprehensive data and news including 11,700+ publicly listed companies, 45,000 supply chain relationships, 100+ industries and 154 commodities or market indicators.

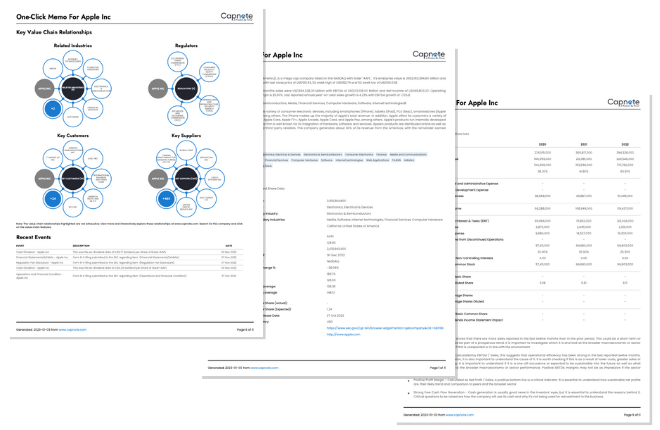

Save Time & Money with Automations

Save time and money with automations like the one-click memo which reduces up to a week's worth of research time into a single click. Automating such tasks enables staff to spend more time on value added work.

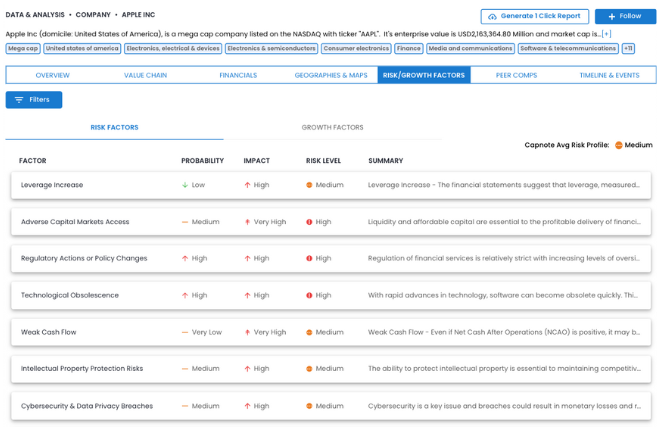

Alignment of Risk Appetite & Opportunities of Interest

Better align teams on risk appetite and opportunities of interest. Capnote’s automated risk and growth factors for industries and companies can be adjusted to suit your preferences or track specific indicators.

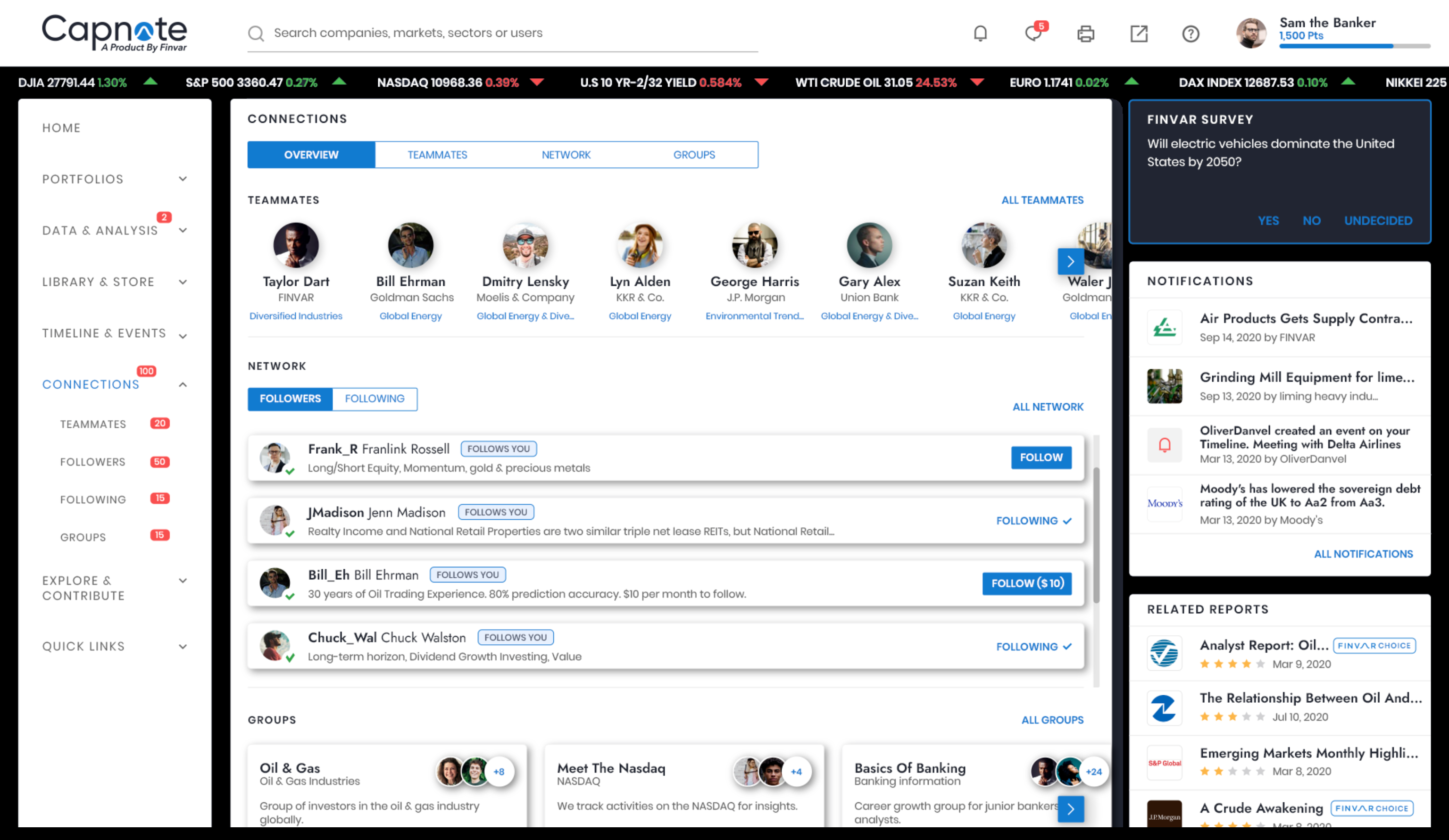

Enhance Collaboration

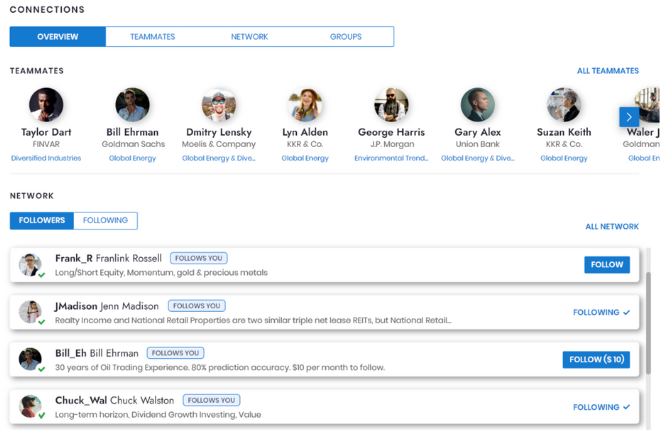

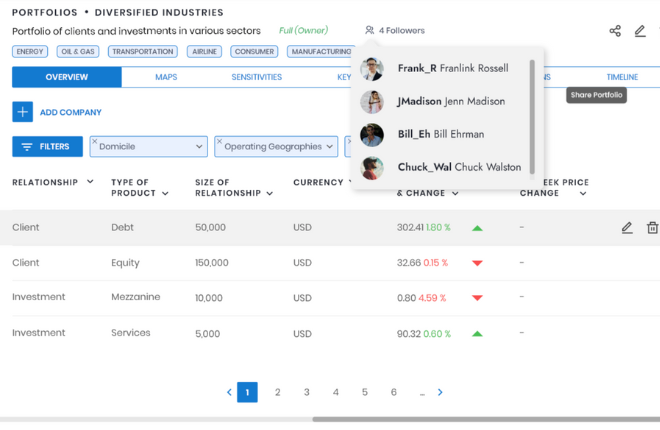

Enhance collaboration across coverage or deal teams in different geographies with a completely private social network, shared portfolios, flexible tagging and personalized notifications.

Democratize Organizational Knowledge

Make better use of organizational knowledge and retain it better in an interactive environment. Rather than just store documents on drive, these can be turned into interactive digital posts or notifications with key dates synchronized among teams.

Getting Started for Corporate Treasury

When a bank requests to license the Capnote Private Platform, we will arrange a discovery call to go through the bank’s precise requirements and preferences. Following a discovery session, a unique and closed platform will be created and the bank’s authorized users will be added onto the platform. The bank will be able to nominate administrative users that monitor employees actions and moderate content on the platform.