Capnote – Wealth Management (Private Platform)

Wealth Management

The Capnote Private Platform is an interactive digital application that has been designed to help Wealth Advisors deepen engagement with their clients, save time and even enhance digital sales capabilities.

According to Deloitte, digitally enabled interaction channels for both clients and advisors are essential to winning business with a generation of clients that are more tech savvy.

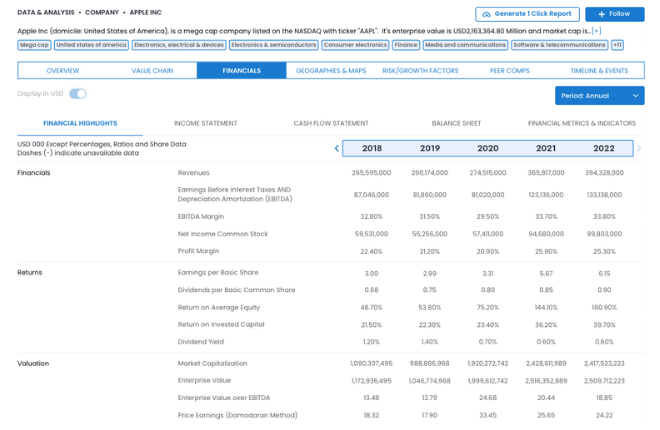

Comprehensive Data & News

Receive access to comprehensive data and news including 11,700+ publicly listed companies, 45,000 supply chain relationships, 100+ industries and 154 commodities or market indicators.

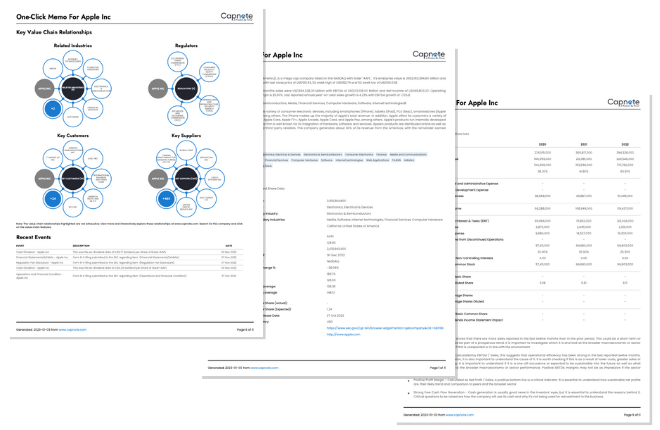

Save Time & Money with Automations

Save time and money with automations like the one-click memo which reduces up to a week's worth of research time into a single click. Automating such tasks enables staff to spend more time on value added work.

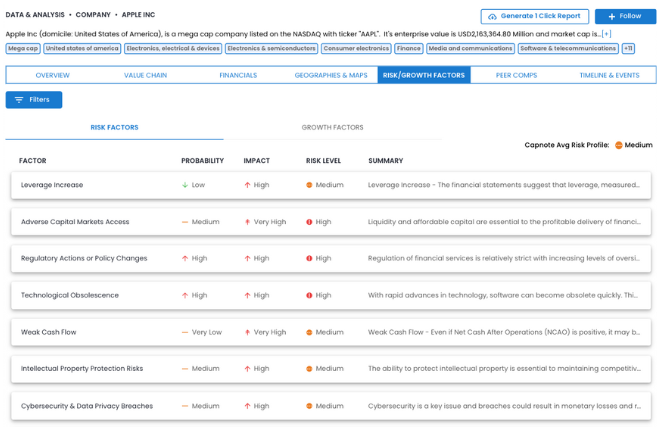

Alignment of Risk Appetite & Opportunities of Interest

Better align teams on risk appetite and opportunities of interest. Capnote’s automated risk and growth factors for industries and companies can be adjusted to suit your preferences or track specific indicators.

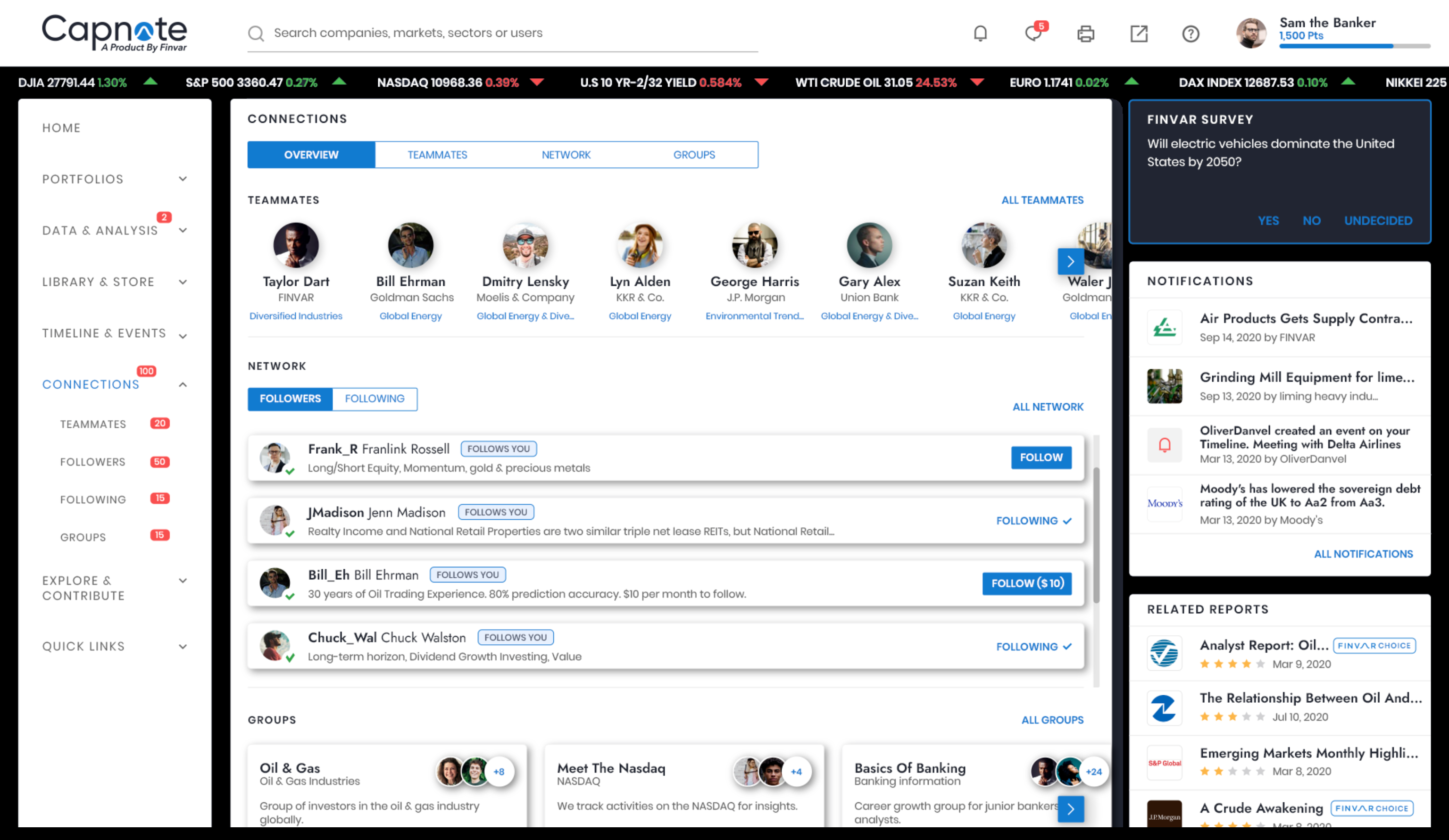

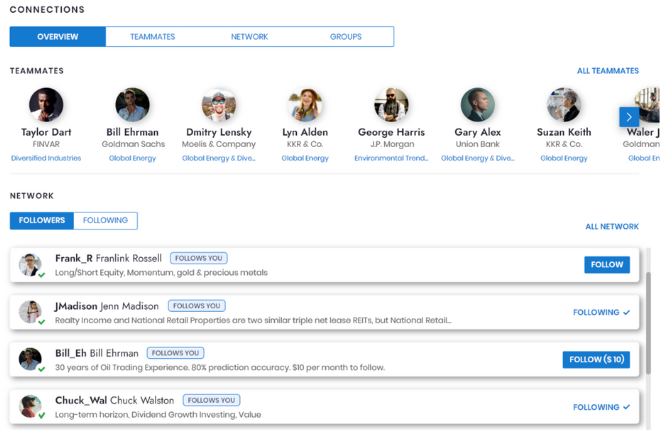

Private Social Network

Deepen client engagement with a private social network where each client is only connected to members of your team, specialists or service providers.

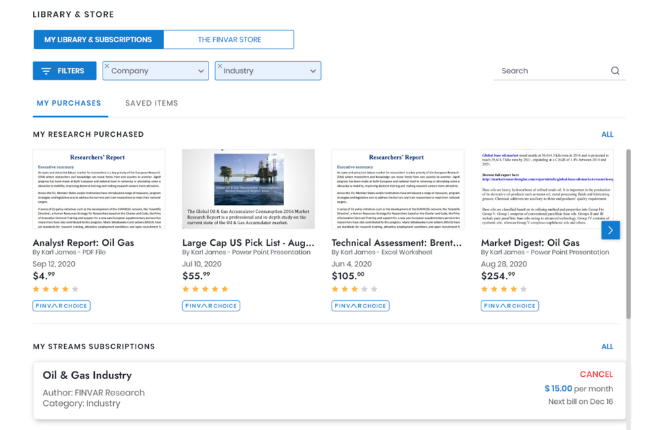

Generate Income

Generate income by marketing and selling products and services directly to clients on the platform. Build a library of reports and research for sale to your clients.

Getting Started for Wealth Management

When a wealth management organization requests to license the Capnote Private Platform, we will arrange a discovery call to go through the organization’s precise requirements and preferences. Following a discovery session , a unique and closed platform will be created and the wealth manager’s authorized users will be added onto the platform. The wealth advisor will be able to nominate administrative users that monitor employees actions and moderate content on the platform.